October 3, 2023

U.S. Home Prices Hit an All Time High in July

This material is for informational or educational purposes only.

Learn How a Signature Financial Advisor Can Help You Today.

3625 Cumberland Boulevard SE

Suite 1485

Atlanta, GA 30339

Signature Wealth Management Group is a Registered Investment Adviser with the U.S. Securities and Exchange Commission located in Atlanta, Georgia. This website is only intended for clients and interested investors residing in states in which the Adviser is qualified to provide investment advisory services. Please contact Signature Wealth Management Group at 678-932-2500 to find out if the investment adviser is qualified to provide investment advisory services in the state where you reside. The Adviser does not attempt to furnish personalized investment advice or services through this website. Past performance is no guarantee of future results. A copy of the Signature Wealth Management Group current disclosure statement (form ADV Part 1) containing the firm’s business operations, services, and fees, is available by accessing the SEC website at www.AdviserInfo.sec.gov. Signature Wealth Management Group will provide form ADV Part 2A to interested parties upon request.

At certain places on our website we offer direct access or ‘links’ to other Internet websites. These sites contain information that has been created, published, maintained or otherwise posted by institutions or organizations independent of Signature Wealth Management Group. Signature Wealth Management Group does not endorse, approve, certify or control these websites and does not assume responsibility for the accuracy, completeness or timeliness of the information located there. Signature Wealth Management Group does not necessarily endorse or recommend any commercial product or service described at these websites.

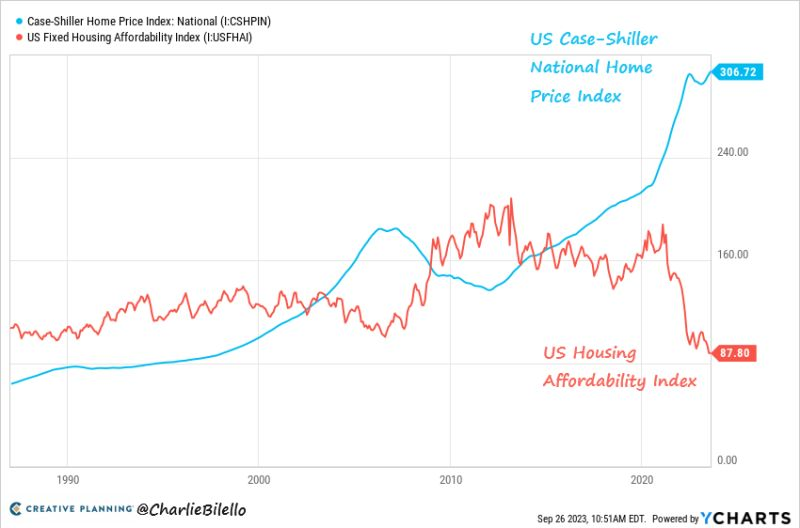

U.S Home prices hit an all time high in July while affordability dropped to new lows. How can home prices continue to rise, while affordability drops? The main culprit seems to be a lack of inventory due to limited building of new homes and Americans who are staying put in homes with debt that was financed at very low rates.

If you are considering moving to a new home, would you leave a rate of 3% to go to a rate of 7.2%? Not likely, so affordability continues to plummet as rates go up, but prices aren’t yet in a downward spiral.

I’m curious to see what will be the tipping point here. Will demand fall enough to finally bring prices down? Will the Federal Reserve lower rates at some point in 2024 due to softness in the economy, making home ownership more affordable?

As you can see, affordability closely followed the home price index for many years and we haven’t seen a gap this wide in the indexes since at least the mid 1980’s. The Federal Reserve is walking a tightrope here as they seek to tame inflation with higher rates, but they may be causing significant distress in the economy.

At times like this, patience would seem to be the best medicine. Home buyers would be best served to wait until home prices and affordability right themselves.

Source: @charliebilello on #twitter