March 6, 2025

Southern Company Update, 4th Quarter 2024

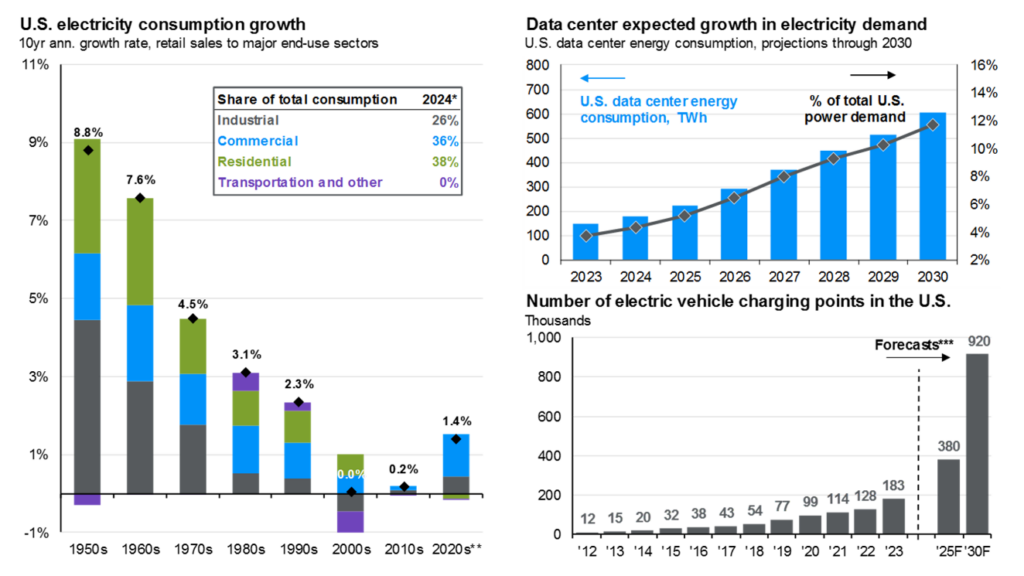

Below is the trend that Southern Company and other utilities are facing over the next 5-15 years. Electricity consumption is, for the first time in about 20 years, expected to increase. That’s the chart on the left. In the 1960-1990’s American homes saw significant technological developments including refrigeration, HVAC units, personal computing, television, etc. Each development required a significant increase in electricity generation. Since the turn of the century, however, residential electricity demand has been flat. Same with industrial electricity consumption. That is expected to pick up thanks to the artificial intelligence arms race expanding data center capacity by about 5x between 2023 and 2030. Add in the trends in electric vehicles and suddenly the forward expected demand for electricity spikes.

Source: JP Morgan Guide to the Markets

Atlanta is one of the expected hubs for data center development including this 2 million square foot development in Bartow County (Bartow Data Center). Currently, Southern Company is projecting over 50,000 megawatts of new incremental load from data centers onto their grid by the mid 2030’s including 10,000 megawatts of advanced commitments. Georgia Power by itself sees an 8,200 megawatt increase in power demand over the next six years (1). The 2025 Integrated Resource Plan (IRP) includes a 112 megawatt expansion of Vogtle units 1 & 2, 268 megawatt expansion of Plant McIntosh in Savannah, continued use of coal-fired plants Bowen and Scherer which arguably don’t actually add megawatt capacity, and long term procurement of 4,000 megawatts of renewable resources by 2035 (2). Georgia Power is also looking at adding an additional 13,000 megawatts of expansion resources through 2037, bringing the cumulative megawatt capacity above 50,000 (3).

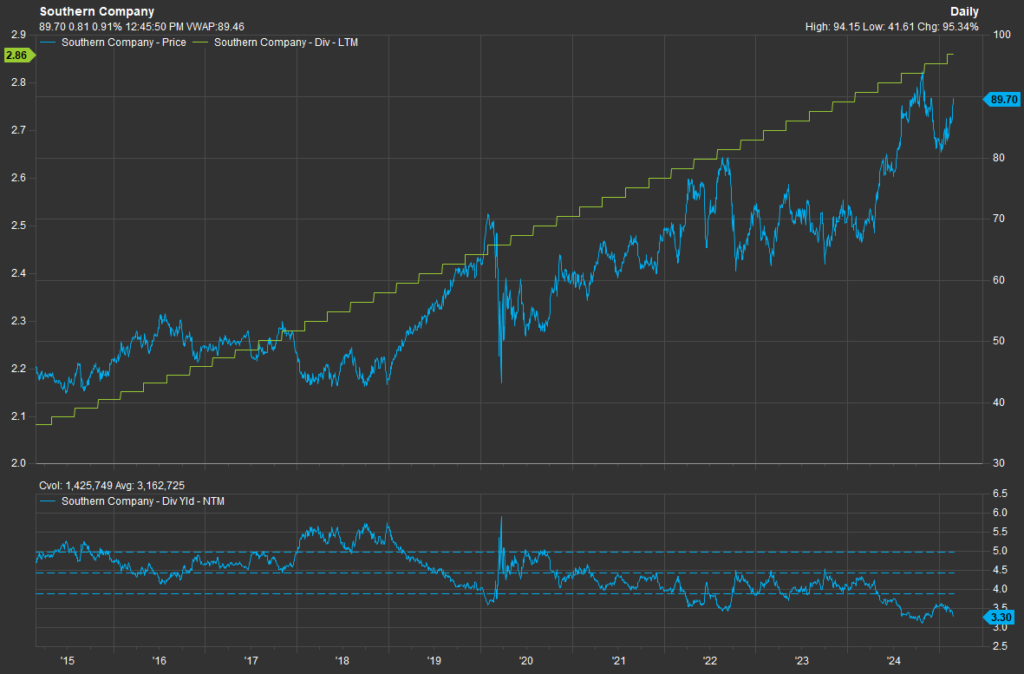

Thus, the road ahead for Southern Company and other utilities is tricky and involves a lot of capital investment to meet emerging demand. This is one reason why utilities have done so well over the last year since the emergence of the AI investment trend. Southern intends on spending about $11.8 billion per year through 2029 on capital investments. The bulk of these investments will be on growth capacity (4).

It is very likely that Southern Company will continue to rely on the capital markets because of the capital expenditure overlay. Between 2020 and 2024, Southern has added about $18.5 billion of debt and issued $1.8 billion in equity. Fortunately, Southern has also grown operating income (before depreciation) from $9 billion to $12.3 billion per year between 2020 and 2024. This is actually a 120 basis point increase in profitability per dollar of total capital (debt and equity). So Southern has been efficient with their capital recently and hopefully that trend continues. If it does then the road to 2030 becomes much smoother for shareholders as Southern moves to accommodate new data center demand on its power grid.

Source: Factset Database

Sources:

- Murchison, Adrianne. Georgia Power plan to meet demand for data centers criticized. Published January 31, 2025. Retrieved from https://saportareport.com/georgia-power-plan-to-meet-demand-for-data-centers-criticized/columnists/adrianne-murchison/

- Georgia Power. Georgia Power Files 2025 IRP Plan to Meet Energy Needs. Published January 31, 2025. Retrieved from https://www.georgiapower.com/news-hub/press-releases/georgia-power-files-2025-irp-plan-to-meet-energy-needs.html

- Georgia Power. 2025 Integrated Resource Plan. January 2025. Docket No. 56002. Retrieved from https://www.georgiapower.com/about/company/filings/irp.html

- Southern Company. Fourth Quarter 2024 Earnings Conference Call. February 20, 2025. Slide 15. Retrieved from Factset Database.

Signature Wealth Management Group is registered as an investment adviser with the SEC. Signature Wealth Management Group only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements.

This report is a publication of Signature Wealth Management Group. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change.

Information contained herein does not involve the rendering of personalized investment advice, but is limited to the dissemination of general information. A professional adviser should be consulted before implementing any of the strategies or options presented.

Information is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), or product made reference to directly or indirectly, will be profitable or equal to past performance levels.