August 27, 2024

Southern Company Update, 2nd Quarter 2024

Utility investing is typically a straight forward prospect with very little surprises, good or bad. This is why utilities are commonly considered “safe haven investments” by academics and investors when the economy turns South. Revenue and earnings growth are generally predictable and the dividend is generally predictable as a result which typically results in lower stock volatility when economic growth is waning.

Artificial Intelligence seems to have changed that narrative, however. Because AI requires extensive computing power, data center demand for utilities throughout the country have increased substantially over the last year. In the latest Southern company earnings call, management cites a 17% increase in existing data center sales year-over-year in the 2Q of 2024. Daniel Tucker, Southern Company CFO, states that 40% of new projects in the pipeline and 80% of potential electric load stem from data centers (1). Valueline reports that the US will need to install more than 10 gigawatts of power to meet the increased electricity demand, expected power demand to jump 3-4x over the relatively flat growth we’ve seen for the last decade (2). This is perhaps the greatest jump in electricity demand history since the creation of the electric grid itself.

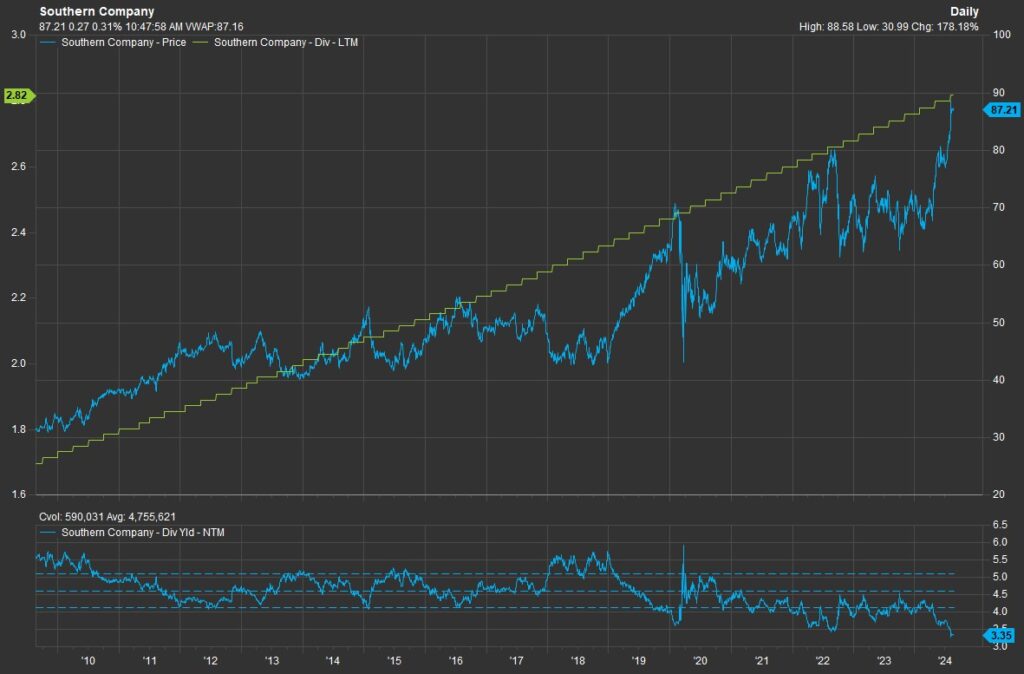

Thus, investors have pushed the stock to all-time highs based on the thesis of faster-than-usual earnings growth driven by data center demand. We don’t typically see utilities trade in this fashion. In fact, the dividend yield (bottom graph) is now about 2 standard deviations below its 15-year average. That’s just a fancy way of saying that the stock price growth has dramatically exceeded the dividend growth over the last year and the price of SO stock is rich relative to the historical dividend yield. The dividend was increased by 2.9% in April, in line with an average yearly EPS growth rate of about 2.3% between 2019 and 2024. The long-term EPS growth target provided by management is 5-7% annually.

Southern Company and other utilities are likely to be surprise ancillary beneficiaries of Artificial Intelligence for a long period of time. These stocks are supposed to be low growth, low volatility, income producing assets. Right now the yield is not that enticing for new investors, with the dividend yield sitting at a 15-year low. But the stock has responded in accordance to the prospect of higher-than-usual future growth.

Source: Factset Interactive charts. Top graph: SO stock price & SO last twelve months dividends per share. Bottom graph: next twelve-month dividend yield & average plus standard deviation (3).

Sources:

- FactSet Research Systems. (n.d.). Southern Company SO 2Q2024 Earnings Transcript (Calendar). Retrieved August 20, 2024, from FactSet Database.

- Valueline. Southern Company SO. Updated August 9, 2024. Written by Zachary J. Hodgkinson. Retrieved from Valueline Database.

- FactSet Research Systems. (n.d.). Southern Company (Interactive Charts). Retrieved August 20, 2024, from FactSet Database.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

Consult your financial professional before making any investment decision.

Earnings per share (EPS) is a company’s net income subtracted by preferred dividends and then divided by the average number of common shares outstanding.