July 1, 2024

“Short Attention Span Theater”

The title of this newsletter refers to a comedy show which appeared on HBO, Cinemax, or Comedy Central (which are the only venues it could have reached me (Jim) as I’m too cheap to pay for premium TV content not related to sports or home improvement shows!) from 1989 to 1994. For a while, it featured comedian Jon Stewart as host and the show consisted of brief clips from comics and (go figure!) upcoming HBO and Cinemax specials. Admittedly, the title of the show stuck with me far longer than the content.

So it is through this lens that I would like to offer some interpretation of what we are seeing with recent “market” activity. Right now, it appears, the market’s attention is focused solely on the description of an attribute known as “Artificial Intelligence,” or in another term, “Generative AI.” AI isn’t so much of a “thing” as it is the continued development of the abilities of computers connected to the internet, to further intuit information through massive searches and then package that collective information back to the user. It provides answers to searches or specific requests (such as the enterprising college student looking to have a term paper written without actually researching much of the topic at hand … not that I would have any parental experience with that! 😊). “AI” is also given credit for helping us solve complex problems by combing through mountains of data available from different sources, and “connecting the dots” in such a way that the pathway to the solution becomes more manageable, whether the problem itself is attempting to cure a rare form of cancer, or add the elusive 10 more yards to your drive on the golf course. And so in regards to AI and investing, anything that can be connected to it takes on an investment benefit, and the closer to the source, the better.

I’m not downplaying the role of AI on our future landscape. AI is largely regarded as impactful on our future lives as the internet is on our current lives. However, I am suggesting that the current market is, as it did in 1998, taking what is now a broad-reaching concept and discounting backwards future financial benefits without regard to the many pathways and pitfalls that may occur as these “AI companies” attempt to monetize those benefits. Does this skepticism imply that we have written off AI as an investment theme? Not hardly, as we maintain positions in our Capital Growth Strategy of several hardware and software companies that are on the leading edge of this technology. However, we also have the investment discipline to keep these companies relatively balanced with other companies, which is a far cry for how the market is treating them now:

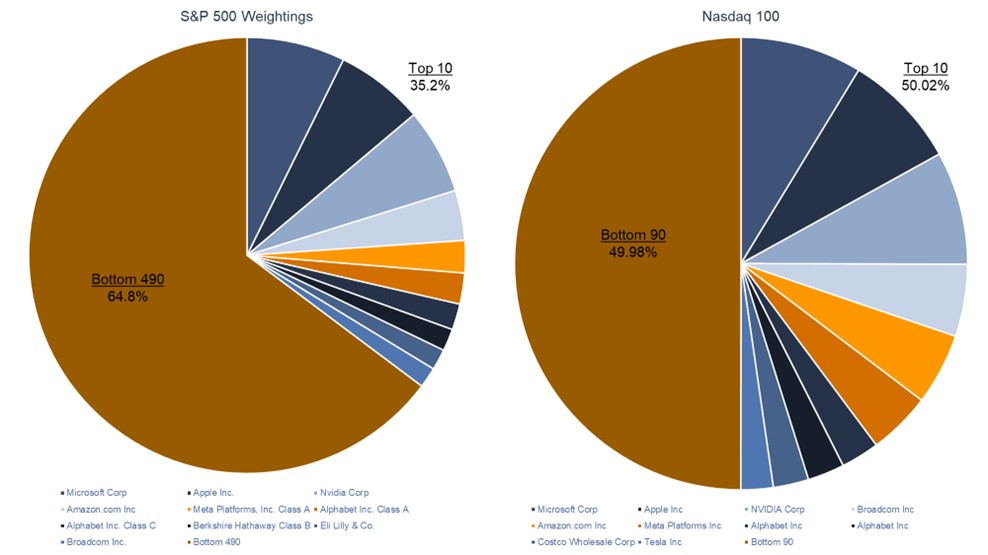

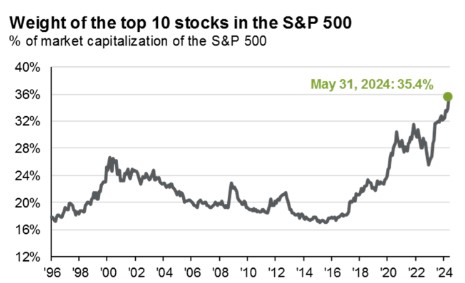

Currently, the S&P 500 has a 35% weighting from the top 10 largest companies in the index. The Nasdaq is weighted even more to the extreme with the top 10 largest companies forming over half of the index. Source: https://www.slickcharts.com/nasdaq100

Index concentration has grown worse over the years. We are now at an all-time high concentration of the top 10 stocks in the S&P 500. This means that passive investors are deriving more and more returns from a select few stocks, effectively negating the benefits of diversification.

Given all this, we continue to invest in companies that we believe are not only currently profitable, but have demonstrated such over decades, if not generations. And that is reflected in both the income and capital gains we have received for the positions we have held long-term throughout our portfolios.

As always, we appreciate your trust and support. If you have any questions regarding this or anything else with your accounts, please do not hesitate to call. We love hearing from you!

This material is for informational or educational purposes only.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies. The Nasdaq-100® is one of the world’s preeminent large-cap growth indexes. It includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.