June 10, 2023

Plant Vogtle in Detail

The Vogtle nuclear power plant in Waynesboro, Georgia is nearly complete after construction began nearly 14 years ago. It was announced earlier this year that Unit 3 safely reached 100% power and was successfully connected to the Georgia electric grid. Unit 4 has completed hot functional testing and as of May 2nd is ready for fuel loading. Should Unit 4 reach it’s remaining fuel milestones over the course of the year, it should be in-service by December of 2023 (1). This would be the first nuclear power plant in the United States to go into operation since 1996 and is currently the only nuclear facility under construction (2).

This new facility was a massive undertaking and a remarkable engineering feat that has been marred by delays, budget overruns, and the bankruptcy of Westinghouse in 2017. In total, from start to finish, these two units will likely cost over $30 billion with Georgia Power assuming approximately $10.6 billion of capital costs (1). Southern Company shareholders likely recognized some of this cost in the share price, with Southern Company stock underperforming the equal weight S&P utilities index by approximately 27% over 10 years (3).

Not all of the underperformance should be directly contributed to Vogtle 3 & 4, however. A good portion of the underperformance could also be contributed to the Kemper Coal gasification project that ultimately cost Southern Company $7.5 billion and is among the most expensive powerplants in dollars per kilowatt-hour generated (4).

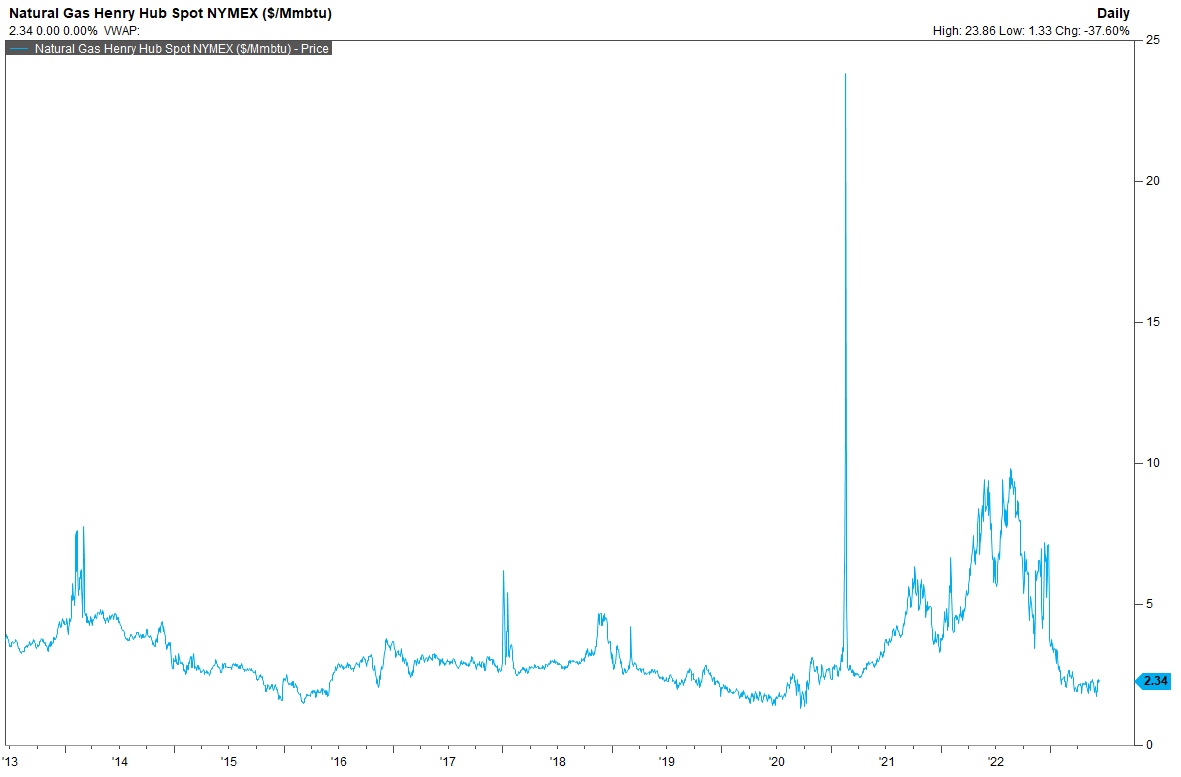

On a more positive note, the addition of new nuclear power generation has the potential for significant variable cost savings should Vogtle 3 & 4 supplant coal and natural gas-fired generators. Because the commodity prices of coal and natural gas fluctuates, the input costs to fire generators also fluctuate. The spot prices for natural gas at the Henry Hub, specifically, has been highly volatile over the last couple of years as seen below.

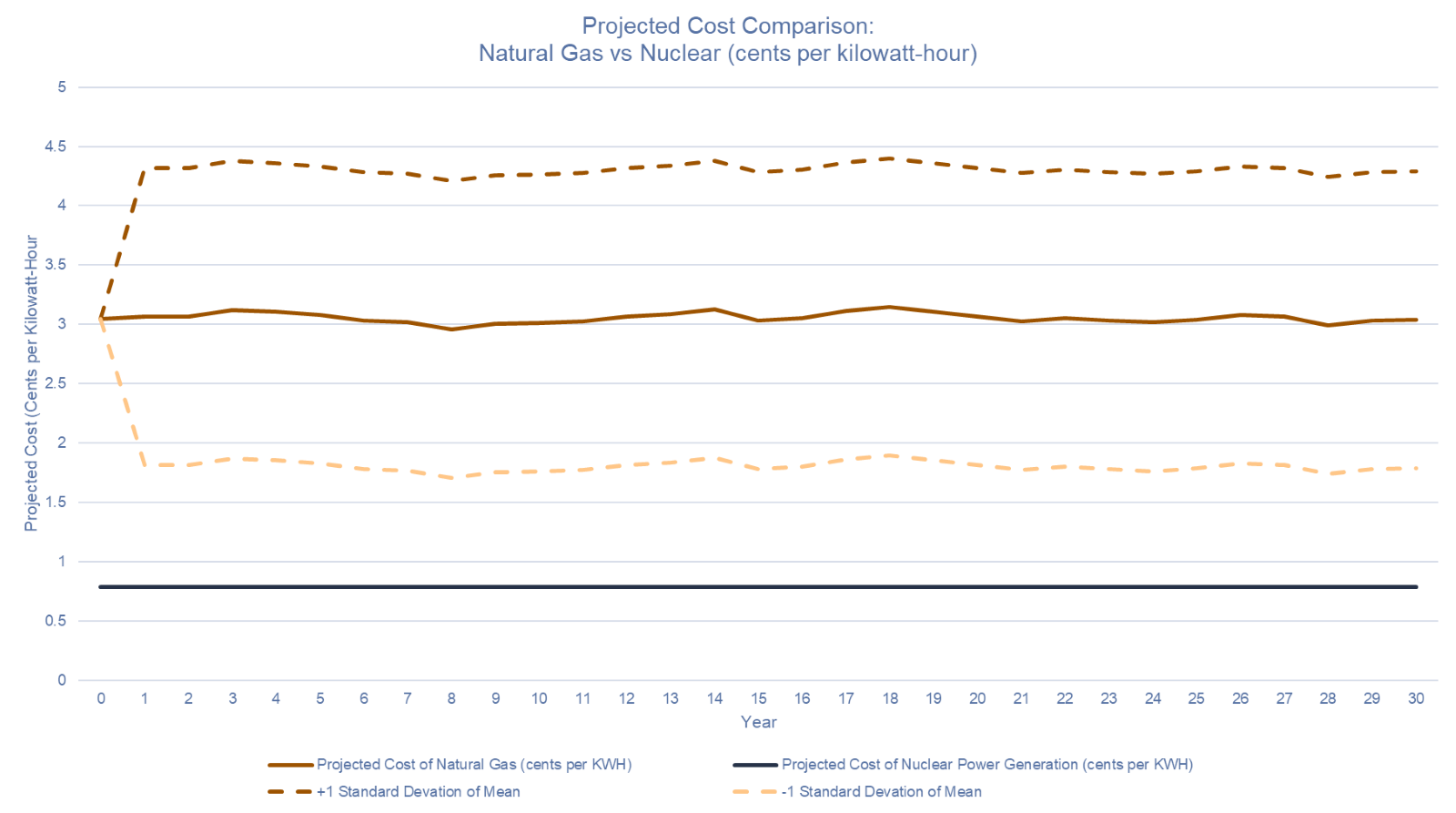

Nuclear power, once built, is a bus that basically drives itself with limited variable input costs. Utilizing a Monte Carlo simulation, forward natural gas prices should fluctuate around 3 cents per Kilowatt-Hour on average with significant deviations between 1.5 cents and 4.5 cents per Kilowatt-Hour. Nuclear power; however, has much smaller and less volatile input costs of around .79 cents per Kilowatt-Hour with a net variable cost savings of 2.21 cents per Kilowatt-Hour. The typical nuclear reactor has a lifespan between 20 and 40 years. Thus, on a 30-year basis, Vogtle 3 & 4 should have a net present value of variable cost savings between $2.5 billion and $8.1 billion depending on the forward cost of natural gas. And that’s just the variable cost savings.

This analysis does not include any tax savings from the depreciation of hard assets nor does it include any investment recovery approved by the Georgia Public Service Commission. Southern Company estimates that cash flows from operations will increase by $700 million per year because of the investments made at this nuclear power plant (1). Thus, it is highly conceivable that the $10.6 billion price tag to Georgia Power is well worth the investment especially if natural gas prices spike like they did in 2022. The same could be said for coal, which should be the primary power source displaced by Vogtle 3 & 4.

Upon completion, Vogtle will produce highly reliable energy for 500,000 homes and for you carbon enthusiasts out there, will reduce carbon emissions by 10 million metric tons annually. The costs for shareholders have already been paid to build this engineering marvel, and going forward should produce much more predictable cash flows for the business than coal or gas-fired generators. In other words, we believe the capital spending issues suffered at Southern Company for the previous five years (including budget overruns and coal gasification issues) have already been priced in and now that the Vogtle project is complete, the predictability of the cash flows should lend to the investability of Southern Company going forward. What was previously a weakness has now become a strength for Southern Company as they have an asset that no other utility in the country can replicate.

Sincerely,

The Signature Wealth Management Team

Sources: Southern Company. First Quarter 2023 Earnings Conference Call. Dated April 27, 2023. Retrieved from https://investor.southerncompany.com/home/default.aspx. Wikipedia contributors. (2023, May 30). Nuclear power in the United States. In Wikipedia, The Free Encyclopedia. Retrieved 12:52, June 15, 2023, from https://en.wikipedia.org/w/index.php?title=Nuclear_power_in_the_United_States&oldid=1157664632 Factset Research Systems. (n.d.). Natural Gas Henry Hub spot price (Interactive Charts). Retrieved June 13, 2023, from Factset Database.

Drajem, Mark. Bloomberg. “Coal’s best hope rising with costliest U.S. Power Plant.” April 14, 2014. Retrieved from https://www.bloomberg.com/news/articles/2014-04-14/coal-s-best-hope-rising-with-costliest-u-s-power-plant?leadSource=uverify%20wall Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results. Consult your financial professional before making any investment decision. Diversification does not guarantee profit nor is it guaranteed to protect assets.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Information is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.