January 30, 2025

“Ol’ Man River”

The expression “Ol Man River” has been in our vernacular as a moniker for the Mississippi River since it was introduced as a song in the Rogers and Hammerstein musical “Showboat” in 1929. Now whether your memory takes you to Paul Robeson’s unworldly bass vocals in the movie version from 1936, or Chevy Chase’s clip singing to his family as they are crossing the “Mighty Mississip” in National Lampoon’s “Vacation,” will probably be generational. But the visual I am trying to create actually comes from the duo “Indigo Girls” in a song entitled “Ghost” where Emily Salyers sings:

“And the Mississippi’s mighty

But it starts in Minnesota

At a place that you could walk across

With 5 steps down”

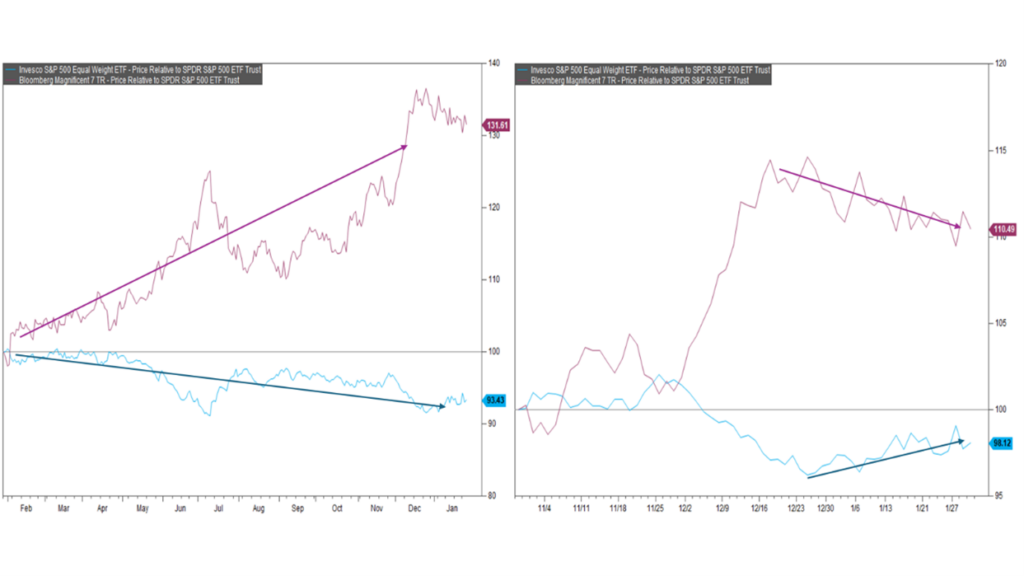

As is typically the case, relating one of my musical references to the current market activity is quite the challenge. But the visual that I (Jim) am trying to portray is that the river that spans tens if not hundreds of miles in the Mississippi Delta as it enters the Gulf of ….. (Insert your politically preferred name here!) starts as a small stream in its headwaters. As to the “Market,” what we have been living with over the last year has been the narrowest leadership on record, where a vast majority of the gains seen have come from only 7 of the companies, and those 7 are those that are most closely connected with the theme of Artificial Intelligence. There was a significant reversal of this theme on Monday, as the “Magnificent 7” and/or AI-related stocks suffered some of their largest single day pullbacks on record, while many of the rest of the stocks were markedly higher!

Pictured: Since February 2023 (left graph), the Magnificent 7 (purple) outperformed the equal-weight S&P 500 (blue) relative to the S&P 500. That trend is showing a short-term reversal (right graph) with the Mag-7 falling relative to the S&P while the equal weight gains relative to the S&P.

This doesn’t necessarily mean the AI theme is over in a day, or that the gains seen in Consumer Staples, Consumer Discretionary, or Financial stocks will swell to the size of the Mississippi River, but rather market participation should broaden out much as does the Mississippi Delta, to include those other viable and profitable companies.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

This material is for informational or educational purposes only.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

The term consumer staples refers to a set of essential products used by consumers. This category includes things like foods and beverages, household goods, and hygiene products as well as alcohol and tobacco. These goods are those products that people are unable—or unwilling—to cut out of their budgets regardless of their financial situation.

Consumer discretionary is a term that describes goods and services that consumers consider non-essential but desirable if their available income is sufficient to purchase them.