July 27, 2023

NextEra Energy; July, 2023

Institutional investors have invested in NextEra Energy stock (NYSE:NEE) over the last decade because of the low volatility investors get from utilities, the population growth rate in Florida, and Next Era’s consistent dividend growth rate of around 10% per year.

Unfortunately, that can also mean that share prices of Next Era got expensive as companies which offer low volatility and consistent growth were bid up by investors. For example, Next Era’s dividend yield (blue below) was consistently above 3-3.5% in the recovery following the financial crisis. But that yield steadily fell as share price (purple) outgrew the dividend. In 2020 & 2021, NextEra was one of the few utilities with yields below 2%. For a utility, that is expensive.

Source: Factset Database

In 2020, NextEra stock (blue) reached valuations that rivaled large cap tech stocks like Apple (purple) and Microsoft (green). In late 2021, NextEra’s price per unit of earnings or PE ratio hit the 35x level typically reserved for growth stocks. Even though NextEra consistently hits earnings growth rates above 5% year-over-year, they are still a utility and growth drivers are typically only driven by population growth rates and state-approved increases in power pricing. Thus, it did not really make sense to value a utility, even one as consistent as NextEra, like a high growth technology company. Fortunately, it appears that the market has come to its senses. Over the last 6 months, Microsoft & Apple have resumed their march to higher valuations, diverging from NextEra which is much more reasonably priced at 22x earnings.

Source: Factset Database

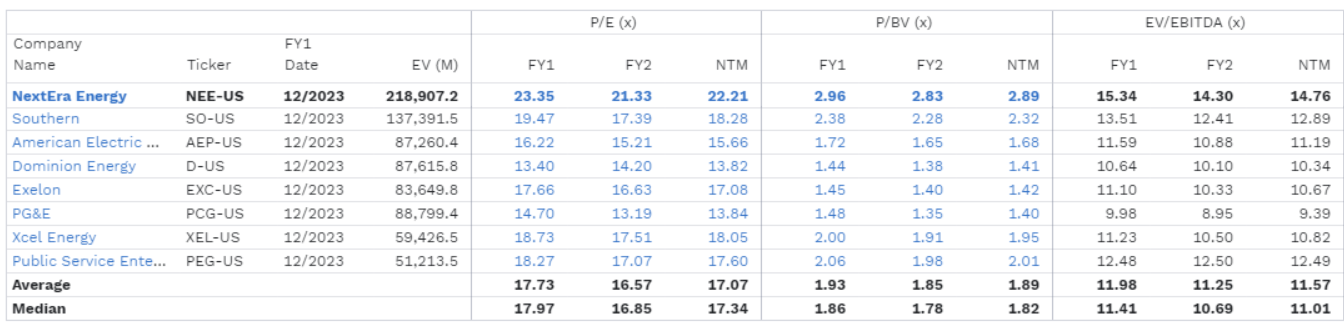

Currently, NextEra’s PE ratio is trading at a discount to its 5-year historical average and its dividend yield is trading higher than its 5-year historical average. Both show that NextEra is trading at a fair discount. However, NextEra is still trading at a healthy premium to its utility counterparts, as shown in the table below. They currently have a PE, Price-to-book-value, and Enterprise Value-to-EBITDA well above the average and median of its comparable utilities.

Source: Factset Database

However, NextEra consistently maintains higher margins, a faster historical dividend growth rate, and higher profitability ratios than other comparable utilities. One way they’ve done so is through their diversified power generation asset base with NextEra Energy Resources and Florida Power & Light. Because NextEra generates a higher percentage of power from renewable sources and nuclear, they were able to lower their variable costs throughout 2021 & 2022 when the price of coal and natural gas skyrocketed. Because NextEra has lower variable costs, they can consistently achieve higher margins and returns relative to their competitors, specifically the ones that utilize high percentages of coal generation.

Source: NextEra Energy June Investor presentation, slides 13 & 15.

Looking ahead, NextEra is closer to its true “fair value” today than it was back in 2021. Whether it has reached or fallen below that “fair value” is yet to be seen. NextEra (and every utility now) has the headwind of higher interest rates. Utilities tend to trade inversely to bond yields. So, the increase in bond yields over the last year and a half should: a) increase borrowing costs for utilities and b) place bonds as a viable alternative to utility stocks for income-seekers. However, there comes a point when utilities like NextEra become bargains based on PE, dividend yield, or the more nebulous “fair value.” We do not believe Next Era is at that point just yet, but we would continue to hold it as part of a conservative and diversified portfolio.

Sources:

- FactSet Research Systems. (n.d.). NextEra Energy NEE price & yield (Interactive Charts). Retrieved July 19, 2023, from FactSet Database.

- FactSet Research Systems. (n.d.). NextEra Energy NEE, Microsoft MSFT, & Apple AAPL NTM PE (Interactive Charts). Retrieved July 19, 2023, from FactSet Database.

- FactSet Research Systems. (n.d.). NextEra Energy NEE comparables (Company/Security). Retrieved July 19, 2023, from FactSet Database.

- NextEra Energy. June 2023 Investor Presentation. Slides 13 & 15. Published June 2023. Retrieved from https://www.investor.nexteraenergy.com/news-and-events/events-and-presentations

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results. Consult your financial professional before making any investment decision. Diversification does not guarantee profit nor is it guaranteed to protect assets.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Information is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

Neither the named representative nor Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your tax professional for specific guidance.

Price-to-earnings is price divided by consensus analyst estimates of earnings per share for the next 12 months as provided by IBES since January 1998 and by FactSet since January 2022.

Price-to-book ratio is the price divided by book value per share.

Return on equity (ROE) is the measure of a company’s net income divided by its shareholders’ equity.

The enterprise value to earnings before interest, taxes, depreciation, and amortization ratio (EV/EBITDA) compares the value of a company—debt included—to the company’s cash earnings less non-cash expenses.