January 30, 2025

Market Update: January 21, 2025

Welcome to the Monthly Market Update from Signature Wealth Management. I’m Brian Ransom, Research Director from Signature Wealth and here’s what happened in the market this month.

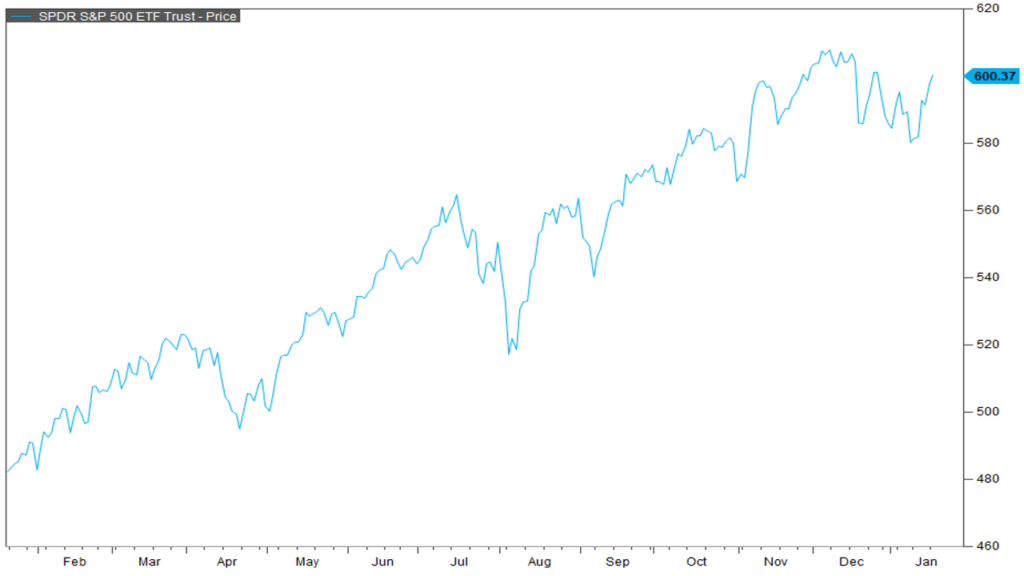

January has had a pretty decent start for 2025 with the market up about 2% as of January 21st. We had previously been in a downward trend but have recently broken out of that trend and appear to be marching back towards all-time highs. At least until this week when AI stocks were disrupted.

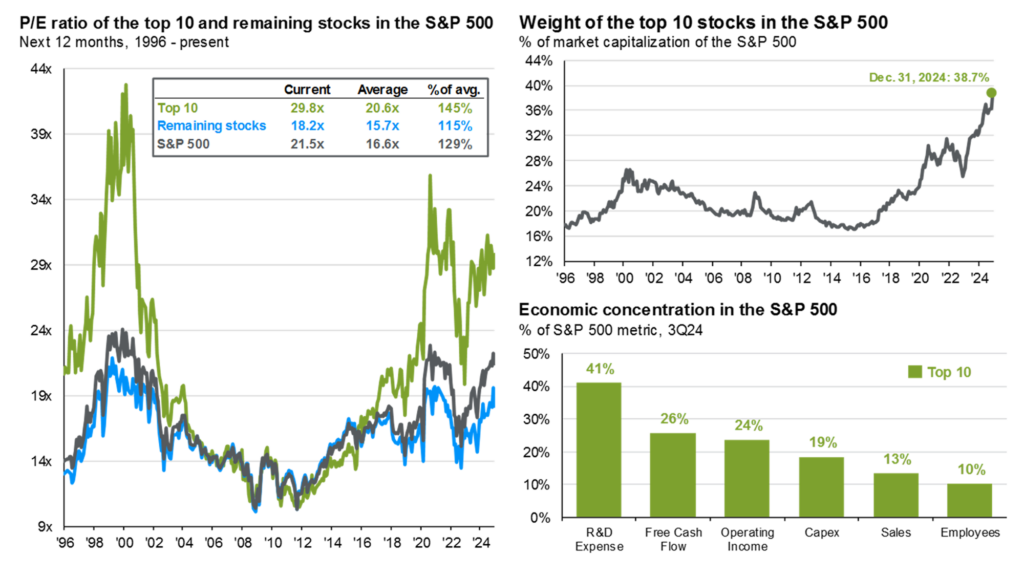

As we enter into 2025 and look ahead for the markets, I wanted to point out the unique idiosyncrasies of the current market that are really unprecedented. By now, everyone should be aware of the domination of the top 10 stocks in the S&P 500. These are the familiar names: Microsoft, Amazon, Meta, Apple, Nvidia, etc. Focusing your attention on the graph on the left, the valuation of these names has climbed to very high levels. While these valuations are not nearly as alarming as 2021 or 1999 levels, they’re still quite high. More unprecedented, however, is the graph on the top right. The concentration of the top 10 stocks within the S&P 500 is now nearly 40%. This is the highest concentration of stock weighting for the data we have available going back to 1996. Furthermore, these 10 companies are spending. A LOT. Just 10 companies account for 41% of R&D and 19% of capital expenditures throughout the entire S&P 500 index which is composed of 490 other stocks.

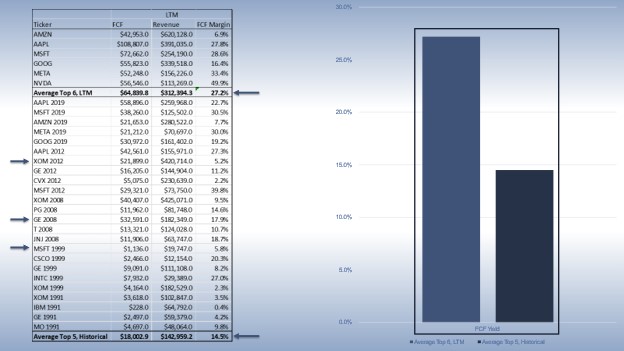

Yet despite this level of spending, these firms are significantly more profitable than any other concentration point in history. The free cash flow margin for the top 6 firms is nearly 30% and almost double the average historical free cash flow margin in history. In other words, these 6 firms are WAY outsizing the rest of the market in terms of value. But they’re also WAY outsizing the rest of the market on spending AND they’re STILL the most profitable firms going back to 1991. They’re more profitable than Exxon Mobile back in 2012, considered the largest firm in US history at the time. They’re more profitable than GE in 2008, considered the best run firm in US history at the time. And they’re more profitable than Microsoft in 1999 when it was considered a monopoly and dominated the tech market. The conclusion to draw here is we are in unprecedented times of market concentration and profitability. Thus, it’s anyone’s guess what happens next because there is no historical analogue to today’s market.

In the short term, we are starting to see a re-broadening out of the stock market this week. Both the equal weight S&P 500 in blue and the Russell 2000 small caps in purple showed strength on the back half of last year relative to the S&P 500. This meant broad-based, unconcentrated returns throughout the market and was a sign of healthy stock returns. Beginning in November, however, both indices gave up those returns. That trend has since reversed and that’s a positive short-term indicator for the market writ-large.

Thanks for joining for the monthly market update! We have a new podcast called “Business Tales.” You can find Business Tales on all your favorite podcasting apps. Also, our website is full of economic, financial planning, and market content. For those looking for more information please visit our website at signaturewmg.com. And don’t forget to like and subscribe.

Sources:

- FactSet Research Systems. (n.d.). S&P 500 (Interactive Charts). Retrieved January 22, 2025, from FactSet Database.

- JP Morgan Asset Management. Guide to the Markets. 1Q 2025, updated December 31, 2024. “S&P 500: index concentration, valuations and earnings.” Retrieved from https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/

- FactSet Research Systems. (n.d.). RSP & Russell 2000 (interactive charts). Retrieved January 22, 2025, from FactSet Database.

Signature Wealth Management Group is registered as an investment adviser with the SEC. Signature Wealth only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements.

Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change.

Information contained herein does not involve the rendering of personalized investment advice, but is limited to the dissemination of general information.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

Always consult an attorney or tax professional regarding your specific legal or tax situation.

The price-to-earnings (P/E) ratio measures a company’s share price relative to its earnings per share (EPS).

Free cash flow (FCF) is a company’s available cash repaid to creditors and as dividends and interest to investors.

R&D stands for research and development, which is the process of developing new products, services, or processes.

The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 7% of the total market capitalization of that index, as of the most recent reconstitution. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Forward-looking statements are not guarantees, and they involve risks, uncertainties and assumptions. The use of words such as “will”, “may”, “could”, “should”, and “would”, as well as any other statement that necessarily depends on future events, are intended to identify forward-looking statements.

Information is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

The S&P U.S. Style Indices measure the performance of U.S. equities fully or partially categorized as either growth or value stocks, as determined by Style Scores for each security. The Style series is weighted by float-adjusted market capitalization (FMC), and the Pure Style index series is weighted by Style Score subject to the rules described in Index Construction.

All information presented prior to an index’s Launch Date is hypothetical (back-tested), not actual performance. The Index returns shown do not represent the results of actual trading of investable assets/securities. S&P Dow Jones Indices LLC maintains the Index and calculates the Index levels and performance shown or discussed, but does not manage actual assets. Please refer to the methodology paper for the Index, available at www.spdji.com for more details about the index, including the manner in which it is rebalanced, the timing of such rebalancing, criteria for additions and deletions, as well as all index calculations.