December 31, 2024

Market Update: December, 23, 2024

Welcome to the Monthly Market Update from Signature Wealth Management. I’m Brian Ransom, Research Director from Signature Wealth and here’s what happened in the market this month.

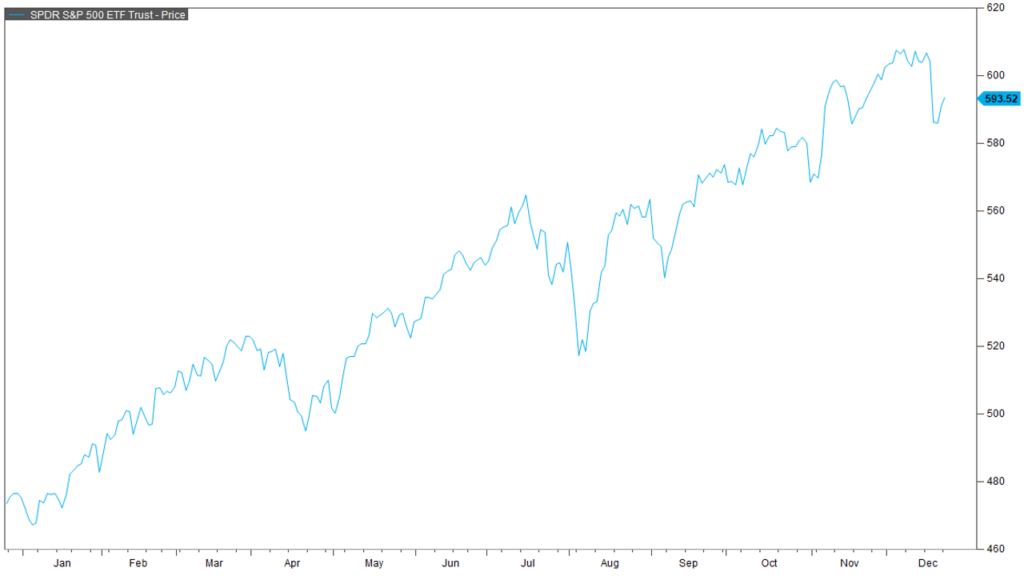

To end the year, the market had a strong rally following the results from the presidential election. But we have run into a bout of volatility in the middle of December. Causing the spike in volatility was a clear change in language and direction from the Federal Reserve that caused a sharp selloff in bonds and stocks alike.

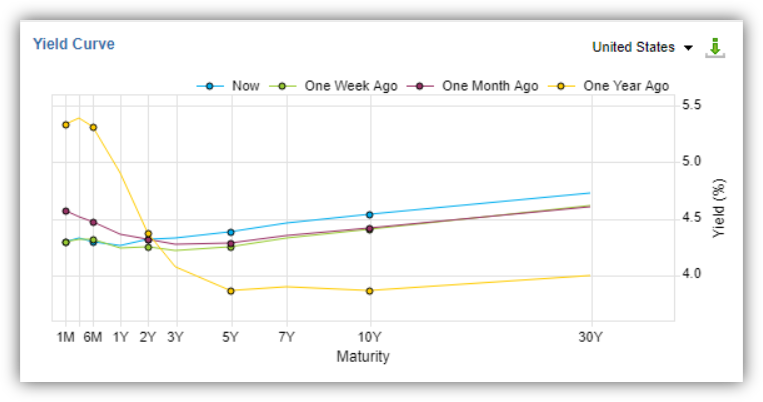

While the December meeting from the Federal Reserve did result in an interest rate cut, Chairman Powell felt the need to reset market expectations for further rate cuts going forward. Quote: “I think that a slower pace of rate cuts really reflects both the higher inflation readings we’ve had this year and the expectations that inflation will be higher” in 2025. Language like this caused long term interest rates shown here in blue to rise relative to last month.

As a result, market expectations for a cut in the January meeting are now essentially zero. Likewise, the market is really only pricing in 1 or 2 rate cuts by the third quarter of 2025. This in turn caused a heavy selling day that resulted in a 3% drop in the S&P on December 17th.

Looking ahead to 2025, the market is pricing in a lot of positivity for both the economy and market returns. Shown here is the Price to Earnings ratio or PE ratio for the S&P 500 in blue and the equal weight S&P in purple. The PE ratio is a measure of how much investors are willing to pay for a dollar of earnings. Currently, the S&P is pricing in $21.47 per dollar of earnings. Generally speaking, I would consider this PE ratio elevated just based on the fact that the last time the PE ratio was this high was in 2021 and shortly thereafter, prices started to fall beginning in 2022. I would point out that this ratio is not a great timing indicator and can remain elevated for a long period of time. In this case, the PE ratio was elevated for almost 2 years before finally correcting in 2022. While the market cap weighted S&P 500 has an elevated PE, the equal weighted index does not. It’s PE ratio is only 16.7x and is no where near the highs set in 2021. This implies that there are a lot of expensive names sitting at the top of the S&P, but not all 500 names are necessarily expensive based on this ratio.

Going into 2025, I would absolutely keep an eye on the 10-year treasury, shown in blue. The last two times the 10-year treasury yield crossed above the 4.5% range; we saw some increased volatility in the stock market (shown in purple). The 10-year tends to respond to variables like inflation, economic health, and Fed messaging. 2 of the 3 were front and center in the last Fed meeting. We are right at a 4.5% yield as we speak.

Thanks for joining for the monthly market update! We have a new podcast called “Business Tales.” You can find Business Tales on all your favorite podcasting apps. Also, our website is full of economic, financial planning, and market content. For those looking for more information please visit our website at signaturewmg.com. And don’t forget to like and subscribe.

Sources:

- FactSet Research Systems. (n.d.). S&P 500 (Interactive Charts). Retrieved December 23, 2024, from FactSet Database.

- FactSet Research Systems. (n.d.). Treasury yield curve (markets). Retrieved December 23, 2024, from FactSet Database.

- FactSet Research Systems. (n.d.). Policy Rate Tracker (markets). Retrieved December 23, 2024, from FactSet Database.

- FactSet Research Systems. (n.d.). S&P 500 & RSP NTM PE ratio (interactive charts). Retrieved December 23, 2024, from FactSet Database.

- FactSet Research Systems. (n.d.). 10-year US treasury yield & S&P 500 (interactive charts). Retrieved December 23, 2024, from FactSet Database.

Disclosures:

Signature Wealth Management Group is registered as an investment adviser with the SEC. Signature Wealth only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements.

Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change.

Information contained herein does not involve the rendering of personalized investment advice, but is limited to the dissemination of general information.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

Always consult an attorney or tax professional regarding your specific legal or tax situation.

The 10-year treasury note represents debt owed by the United States Treasury to the public. Since the U.S. government is seen as a risk-free borrower, investors use the 10-year treasury note as a benchmark for the long-term bond market.

The price-to-earnings (P/E) ratio measures a company’s share price relative to its earnings per share (EPS).

Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Forward-looking statements are not guarantees, and they involve risks, uncertainties and assumptions. The use of words such as “will”, “may”, “could”, “should”, and “would”, as well as any other statement that necessarily depends on future events, are intended to identify forward-looking statements.

Information is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

The S&P U.S. Style Indices measure the performance of U.S. equities fully or partially categorized as either growth or value stocks, as determined by Style Scores for each security. The Style series is weighted by float-adjusted market capitalization (FMC), and the Pure Style index series is weighted by Style Score subject to the rules described in Index Construction.

All information presented prior to an index’s Launch Date is hypothetical (back-tested), not actual performance. The Index returns shown do not represent the results of actual trading of investable assets/securities. S&P Dow Jones Indices LLC maintains the Index and calculates the Index levels and performance shown or discussed, but does not manage actual assets. Please refer to the methodology paper for the Index, available at www.spdji.com for more details about the index, including the manner in which it is rebalanced, the timing of such rebalancing, criteria for additions and deletions, as well as all index calculations.

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. Changes in the CPI are used to assess price changes associated with the cost of living.