March 4, 2025

Growth Scare

A “growth scare” by definition is a sudden fear the economic expansion is faltering. With the S&P 500 and Nasdaq recently hitting one-month lows, signs of unease are appearing. Many interconnected concerns are fueling this apprehension, from policy uncertainties in a new administration to deteriorating macroeconomic signals. And this is happening at a time when the Federal Reserve is still focused on bringing down inflation. The most recent inflation number reported by truflation.com is 2.33% (see below), so very close to the Feds target of 2%. However, the Fed uses CPI as one of its key data points, and the January 31st CPI came in at 3.0% according to the Bureau of Labor Statistics. So, this implies that the data that the Fed is looking at is not yet giving the all clear to bring interest rates down.

With certain parts of the economy showing cracks and inflation still relatively high, it puts the Fed in a difficult spot. During the fall of 2024, the projection was for four Fed cuts in 2025, but that was scaled back to two in December. This scaling back of Fed cuts led to an end of year selloff on what was still an overall good year for the market. Our Capital Growth portfolio for instance still finished the year up 22.24% (see 1.) while the S&P 500 equal weighted index was up just 13.01% (Source: Invesco).

Despite this recent pullback, it has been contained primarily to the more growthy areas of the market. Large cap dividend paying stocks are holding up very well, which is a positive sign for what has been a very concentrated market for the last several years. The Magnificent 7 – Apple, Nvidia, Microsoft, Amazon, Alphabet, Meta, and Tesla have of course been the dominant drivers of returns. We do own several of these companies in our Capital Growth portfolio, but a healthy market is broader and not contained to just a select group. Also, the prospect of falling interest rates tends to be good for dividend paying stocks because investors sell bonds offering comparable yields for dividend stocks which tend to grow their income streams each year.

Proposed tariffs by President Trump on Mexico, Canada, and China do lead to concerns about supply chain disruptions and cost increases on goods purchased from those countries. Deportation policies could also shrink labor pools in key industries like agriculture, driving up wages and prices. But we have seen some companies shift their focus towards spending more on building infrastructure here in the US, such as Apple’s recent commitment of $500 billion over the next four years (source: apple.com). So, as with anything there are likely some plusses and minuses that will come with Trumps use of tariffs.

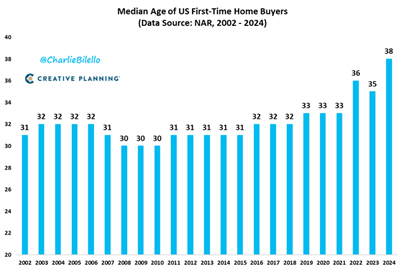

One area of the economy that is also showing signs of a struggle is the housing market. The median age for new home buyers in 2024 was 38 (see below), the highest we have seen in 20 years. The combination of housing prices remaining relatively high and rates on a 30-year mortgage at 6.76% have forced many buyers to put off buying their first home (Source: freddiemac.com). As rates do come down, this will hopefully be a trend that reverses over time. The 30-year mortgage rate was 7.04% on January 16th, so we are headed in the right direction.

Source: @charliebilello on X.com

Despite some cracks appearing here and there in various parts of the economy, we think the best medicine is a sometimes-overlooked resource – patience. We believe growth fears are simply short-term headwinds that will resolve themselves in time. The housing market is experiencing some pain, but that

should slowly start to unwind as rates ease. The Fed has been able to bring inflation down to near its stated goal without causing a recession, which is a rare feat based on past history. Businesses will adapt to policy changes from a new administration and they will find new ways of achieving business goals in spite of what is happening in Washington, positive or negative.

As I said, during times like this, it is best to shift to a long-term focus and exercise patience to achieve the best outcome. We are rewarded with greater returns over time by looking past the volatility that sometimes comes with investing in stocks.

We sincerely appreciate the confidence you have placed is us. If you have any questions, please don’t hesitate to reach out to us.

Sources:

- Performance numbers shown are net of fees. Capital Growth portfolio 1-year return: 25.69%, 3-year return 10.91%, 5-year return 11.97%, 2024 return 22.24%.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Diversification does not guarantee profit nor is it guaranteed to protect assets.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Neither the named representative nor Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your tax professional for specific guidance.

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. Changes in the CPI are used to assess price changes associated with the cost of living.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.