October 1, 2024

Fed Pivot

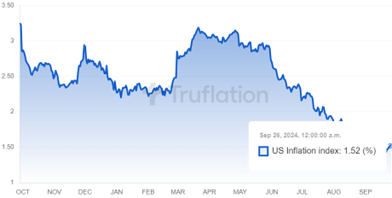

So, we just saw the first rate cut since the Fed took an aggressive approach to taming inflation in the spring of 2022. What was it that the Federal Reserve saw that gave them confidence in shifting their approach? Well, if we look where inflation has come down from in the last few years via truflation.com, we have come a long way. The US inflation index now sits at 1.52%, down from 11.5% at the peak of the recent crisis.

The Federal Reserve has two key mandates – maximum employment and price stability. From an employment perspective, the US employment has remained pretty steady for the last several years at around 60%, so employment wasn’t really the issue. It was inflation that left us all feeling gloomy as we went to the grocery store. So, what led to such massive inflation? Well, policymakers in Washington simply spent too much money following covid and the Federal Reserve kept rates too low for too long – famously missing the signs of inflation in 2021 and calling it transitory. See the chart below:

Source: Charle Bilello

As you can see, the US M2 money supply expanded to levels never seen before following the covid crisis. This led to irrational exuberance in areas like the housing market where sellers could get 10 to 15 offers on their home at more than their asking price and no contingencies.

But, as you can see from the chart, the money supply did fall rapidly and we began to see prices fall in key areas of the economy. Now, after the dramatic drop, the money supply is increasing again, reflecting the Fed’s desire to create a “soft landing” – meaning, since inflation has now come down in the range of our expectations, let’s support the economy with rate cuts and not let it fall into a recession. And so far, the data seems to point to him pulling that off, which is no small feat.

So, we are encouraged by the economic numbers we are seeing and there appears to be no signs of a recession in the immediate future. We of course do have an election coming up and there are many issues to tackle as a country. Elections do have consequences and we would certainly encourage you to do your homework in local, state, and federal elections and vote accordingly. From a stock market perspective, I (Scott) will share this positive note from Andrew Adams of Saut Strategy:

“Over the years I have been told repeatedly that X would happen if so and so wins an election. Back in 2016, many people assured me that I was ignoring the biggest risk in the market and that if Donald Trump won the election the market would crash. The S&P 500 would, of course, go on to gain around 36% from November 2016 to January 2018 after Trump won before running into trouble. Likewise, in 2020, I was assured once again by many that if Joe Biden won, the market would crash. The S&P 500 would, of course, go on to gain around 49% from November 2020 to January 2022 after Biden won before running into trouble. I know I probably won’t convince anyone on this, but I don’t think either one of these periods had much to do with the man sitting in the White House.”

So, Andrew makes a great point in that we have seen the market continue to rise over time despite who is in the White House. This doesn’t diminish the difficult issues we have ahead as a country, but it should also not deter us from maintaining a long-term investment strategy which reflects your goals, time horizon, and risk tolerance. In the meantime, for our clients at Signature Wealth, we will endeavor to invest in solid businesses that will support our client’s growth and income goals. We sincerely appreciate the confidence you have placed is us. If you have any questions, please don’t hesitate to reach out to us.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Neither the named representative nor Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your tax professional for specific guidance.