May 28, 2024

Delta Market Update 2024 – 1st Quarter

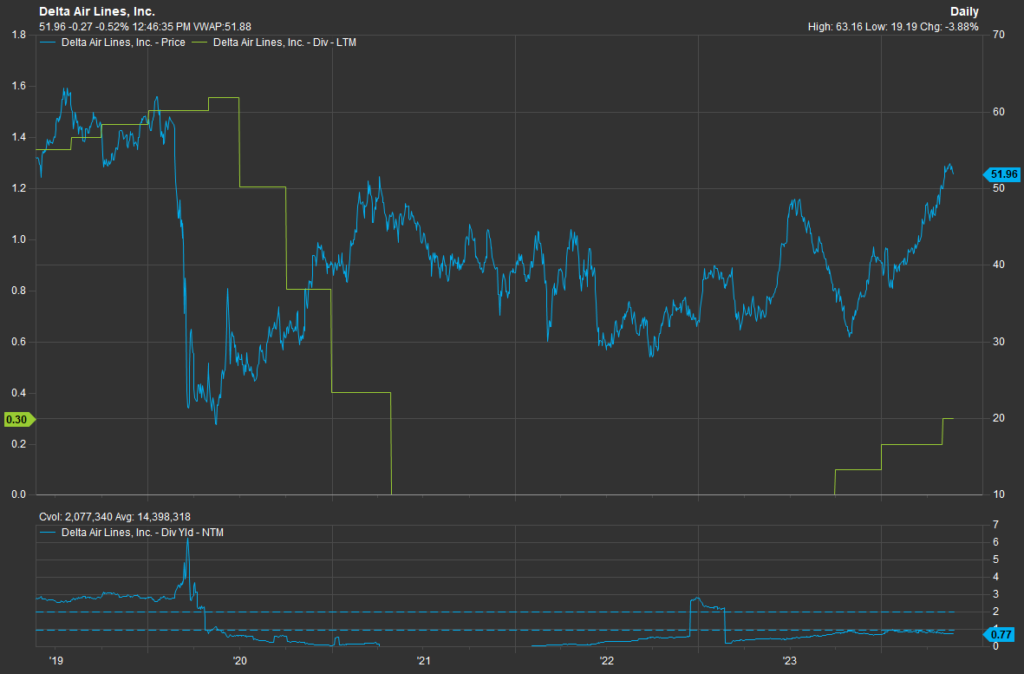

Delta Airlines (NYSE: DAL) shares are trading near their post-pandemic highs after trading 29% higher, year-to-date as of May 22, 2024. They’re still about $10 off their all-time highs, though. The dividend was reinstated in late 2023 after getting the cut since the summer of 2020. Currently, Delta pays $.10/share/quarter and has a yield of about 0.8%. Prior to the pandemic, Delta shares fetched a yield of around 3%.

Investors are likely to shy away from the airlines industry after getting the cyclical reminder that running a profitable airline is incredibly difficult, especially when the economy takes a turn for the worse. Still, it’s a little curious that Delta stock is trading at a discount to all-time highs despite surpassing pre-pandemic records on profitability (last twelve-month earnings hit $5b, surpassing $4.7b highs set in 2019).

This past quarter showed strength in the corporate travel market with sales growth of 14% year/year. There is a strong possibility that the line between business and leisure travelers may be blurring in the post pandemic environment. Work from home technology enables business travelers to extend visits to desirable locations. Delta has almost certainly noticed this trend and alludes to it in the most recent earnings call:

“Generational shifts and evolving consumer preferences are driving secular growth in premium experiences. And business travel demand has taken another meaningful step forward this year with growth accelerating into the mid-teens over last year.” – Delta CEO, Edward Herman Bastian, 1Q2024 earnings call transcript.

This shift in travel demand allows Delta to charge premiums on customers that would otherwise be buying cheaper tickets or not traveling at all. Furthermore, with industry-leading premium seating, Delta is set to take advantage of the business-leisure traveler.

Elsewhere in the business, international travel was up 12%. Total revenue was up 6% while passenger revenue per available seat mile (PRASM, essentially unit revenue for airlines) was up 3%. Delta heads into the summer vacation months with a lot of seasonal growth at its back.

Overall, holders of Delta stock are well positioned to benefit from a business that is also well positioned in the current economic environment with a few secular tailwinds. But, as with all airline stocks, investors should be wary of overweighting positions relative to their total portfolio due to the highly cyclical nature of the airline business. In the event of an economic downturn, there is no place to hide for any airline and investors should be aware of those risks. Please speak to a qualified professional to determine a proper allocation.

Sources:

- FactSet Research Systems. (n.d.). DAL (Interactive Charts: price, dividend LTM, and dividend yield NTM). Retrieved May 22, 2024, from FactSet Database.

This material is for informational or educational purposes only.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

Consult your financial professional before making any investment decision.