March 7, 2024

Delta Market update 2023 – 4th Quarter

Delta Airlines (NYSE: DAL) had a decent year in 2023, increasing net income by about $3.3b year/year. This seemed like it was the first full year of true “normalcy” following the Covid Pandemic. This included the reinstatement of the quarterly dividend at $.20/share, giving DAL stock a yield just shy of 1% as of February 23, 2024.

Delta Airlines still has a ways to go to fully restore the pre-Covid dividend of $.3775/share as well as deleveraging the balance sheet back to 2019 levels. In fact, the pandemic really demonstrated why it’s so hard to both manage an airline as a business as well as invest in it. Because margins are so thin and fixed costs are so high for airlines, any sort of economic pullback can have large disruptions across the entire airlines industry.

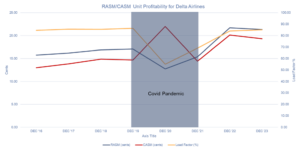

Airline profitability is typically determined by difference between Revenue per Available Seat Mile (RASM) and Cost per Available Seat Mile (CASM). In the airlines industry, the unit sold to a customer is the seat available per mile. Most modern airlines operate on a small spread in RASM relative to CASM and do as much as possible to get as many people in seats as possible (this is called the load factor).

Prior to the pandemic, Delta operated with about a 2-3 cent profit per seat per mile and kept the planes load factor well above 80%. This combination drove Delta to over $4b in net profitability in 2015, 2016, and 2019. The pandemic subsequently inverted the RASM/CASM dynamic to where Delta was losing $.10 per seat per mile and the load factor dropped down to 55% for the year. This was enough for Delta to lose over $12b in 2020, incur $19.8b in new debt, and lose over 69% in stock value peak-to-trough.

Pictured: RASM (blue, left axis), CASM (red, left axis), and Load Factor (yellow, right axis). Source: Factset Database.

The financial damage done to Delta Airlines was substantial yet progress has been made. Since 2020, Delta has reduced debt loads by $11.6b, increased profitability each of the last three years, and reinstated the important dividend. Frankly, management and employees deserve a lot of credit for navigating the turbulence during the pandemic as well as the rebuild following the pandemic.

Ultimately, while the pandemic was a true black swan event, it unfortunately is one example of many events that cause severe financial distress in the airlines industry. In the United States alone, we have seen 23 instances of Chapter 7 bankruptcies in the airlines industry and 65 Chapter 11 bankruptcies (2). This includes Chapter 11’s for United Airlines in 2006, Delta Airlines in 2007, and the combined entity of the AMR corporation as well as US Airways that form American Airlines today. This is simply an incredibly tough business to operate and likewise comes with a bit of “extra” risk for investors.

Sources:

-

FactSet Research Systems. (n.d.). DAL (Company/Security: Financials). Retrieved February 23, 2024, from FactSet Database.

-

Wikipedia contributors. “List of airline bankruptcies in the United States.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, 3 Oct. 2023. Web. 23 Feb. 2024.