October 12, 2023

Current US Debt Level Compared to that of our Country’s History

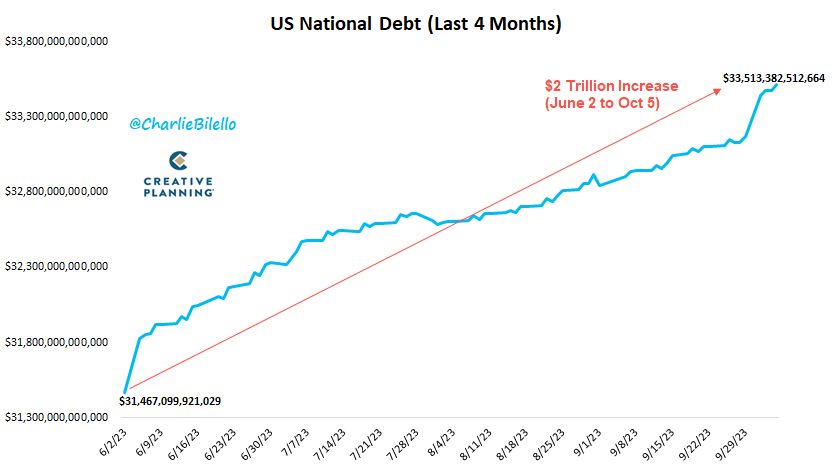

As you can see from the chart, we’ve added $2 trillion in debt in just a couple months. I’m alarmed by the pace at which the US is adding to its debt on a year over year basis these days, so I decided to do some digging to see what our debt history has looked like. Treasury.gov has a record on US debt back to 1790. For the most part, it vacillated in the $25 million to $80 million range for the first 70 years, with an average of $58 million. Then in 1862, it expanded rapidly to $524 million and $1.1 billion the year after. What changed? The Civil War and by 1866 it was up to $2.7 billion.

So, war has been a big driver of debt in our country since the beginning of its existence and that has not changed. Look at all of the trillions spent in Iraq and Afghanistan after 9/11. Look at what we are spending now as we assist in the Russia/Ukraine war and what we will likely spend assisting in the war between Hamas and Israel.

It certainly could be said we don’t do a great job managing domestic spending here in the US, but war adds a component of spending which sends our deficits (how fast we are piling it on each year) and our debt to stratospheric levels.

The Civil War caused our debt to increase on an annualized basis of 133% per year from 1861 to 1865. Likewise, our debt was $5.8 trillion in September 2001, but has risen dramatically to $33 trillion, which is an annualized rate of 8.24% over a 22-year period. The annualized rate of accumulation was much slower; however, the challenge for us now is that interest on that debt is rising fast as the fed raises rates to tame inflation. Interest costs grew 35% in 2022 and are projected to grow by 35% in 2023. In 10 years, interest costs could exceed spending on programs such as Medicaid and defense.

So, if you had a friend whose debt and interest payments were growing this fast, what would you say to them? How would you counsel them to bring their fiscal house in order? As a financial advisor, I’m often counseling my clients on the management of debt and expenses, so when I see our country’s fiscal house look completely irresponsible, it gives me great concern.

And this is not a partisan issue. It appears there is very little concern in Washington over debt and management of our expenses. I’m hoping we will find bold leadership in the near future, which will encourage our country to take a different path before this issue takes us down a road we can’t recover from.

Source: Treasury.gov, PGPF.org, @charliebilello on twitter

This material is for informational or educational purposes only.