August 19, 2021

COVID-19 | A Reflection On The Effects of The Pandemic

COVID-19 – a reflection on the effects of the pandemic.

#covid19vaccination #covid #deltavariant #covid19economy #covid19impact #pandemic #globalpandemic #Signaturewmg #marketupdate #stockmarket

Bad takes and a review of the 2020 Coronavirus Outbreak

Brian Ransom, MBA, MS Research Director, SWMG August 17, 2021

The Scientific Process:

1. Make observations.

2. Formulate a question.

3. Produce a hypothesis.

4. Test the hypothesis.

5. Review, refine, expand, or reject the hypothesis

6. Restart from 1.

The above is the scientific process. Prior to my years as an equity analyst, I was a geneticist. So, I’m familiar with the scientific process and how it’s important to logical, evidence-based thinking.

I bring this up because in early 2020, I published what is quite possibly the worst hypothesis I’ve ever put to paper. The topic was the recent COVID-19 outbreak in Wuhan. And it’s time to review.

First, it became obvious in January and February of 2020 that there was something amiss in Wuhan, China. A novel virus had broken out with a rapid reproductive rate and an unclear mortality rate. The first time I became alarmed was when I learned that the virus had a 2-week incubation period where the subject does not show symptoms but is still contagious. Usually, this type of incubation period is only reserved for measles and chicken pox. SARS does not show this type of incubation. This was my observation, the first step in the scientific process.

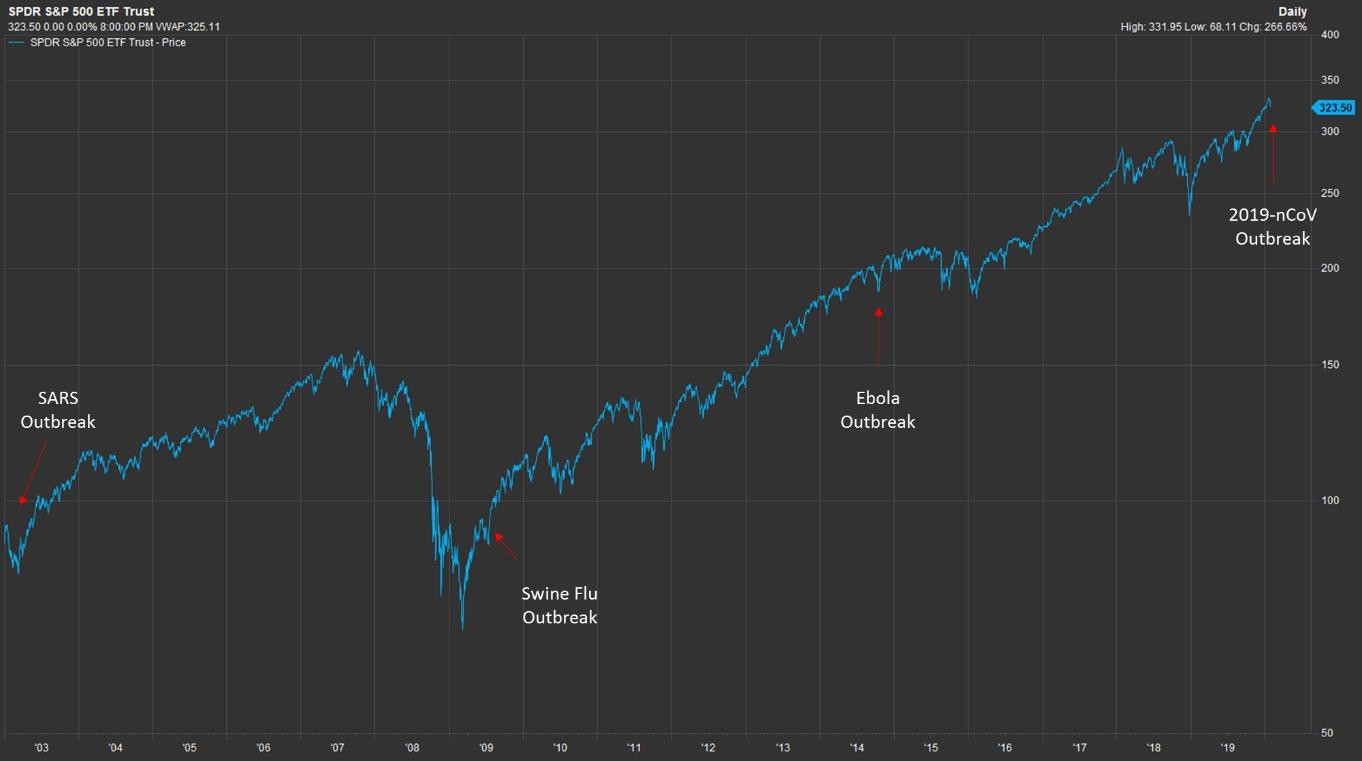

My question to formulate was first, could this virus spread outside of Wuhan? And two, would this have an impact on the markets? Keep in mind, this article was written on January 28, 2020 and I did not have the benefit of hindsight. But I did have previous outbreaks to base my hypothesis on. The 2014 Ebola outbreak in West Africa, the 2009 Swine Flu epidemic, and the 2003 SARS outbreak all killed thousands of people and produced fairly significant market pullbacks. But none resulted in a global pandemic, all were fairly well contained, and the market rapidly recovered. None of these outbreaks produced a bear market or recession that could be identified on a 15-year chart.

Furthermore, this outbreak was in China who has a track record of containing and defeating outbreaks of novel viruses before they spread around the world. The overconfidence in the leading disease- management institutions throughout the world produced what is easily my worst take: “The Chinese, the CDC, and the World Health Organization are fully capable of controlling this epidemic.”

Nope – that didn’t happen! If it weren’t so tragically wrong, that statement would almost be comical. So, my hypothesis, which would get tested and rejected with extreme prejudice, boils down to: “Therefore, clients should not worry about the effect Wuhan Coronavirus has on their investments.”

Obviously, this hypothesis fails testing.

All told, the virus spread to every corner of the world, infected 200,000,000 people, has killed 4,300,000 in counting. That’s 70.5x more deaths than seasonal flu, 380x more deaths than the 2014 Ebola outbreak (1), 15x (estimated) more than the 2009 Swine Flu epidemic (2), and 5,556x more deaths than the SARS outbreak despite a mortality rate that’s 10x as high as COVID-19 (3).

COVID-19 induced a stock market panic that resulted in a 34% pullback in the S&P 500 including 4 circuit breaker triggers to halt trading, the shortest recession on record, and we were teetering on a depression if the economic anxiety was sustained (4).

Ultimately, the lessons to be learned here are 1. Don’t overestimate the capabilities of disease- containment institutions, 2. Don’t underestimate the power of a high reproductive rate on a low- mortality virus, and 3. Don’t underestimate the economic damage a global pandemic can have.

We’ll likely be experiencing the economic ramifications of this pandemic for a long time. Lumber tripled in price between November 2020 and May 2021 before falling right back down to its original price (5). Worldwide semiconductor shortages are expected to persist until 2023, causing shortages in everything from new vehicles to iPhones (6). There is new research on the long-term ramifications of catching the virus and the ongoing healthcare costs associated with it. And most tragically, the loss of human lives that cannot be replaced.

Because of the new Delta variant, we are experiencing a new wave in hospitalizations and associated economic restrictions to curb the spread. The Delta variant has the reproductive rate equivalent to that of measles, the most contagious virus documented (8). With only 15% of the world’s population fully vaccinated, there is a very high likelihood that the virus will continue to mutate and spread (9). Fortunately, it appears that the vaccines developed by Pfizer and Moderna are extremely resilient, remaining effective against all variants. Thus, it appears that the worst is behind us both in public health and economically. As an example, it appears that gross domestic product has been restored to its previous growth trajectory implying that the economy is in good shape despite the Delta variant resurgence.

Source: https://fred.stlouisfed.org/series/GDP

Booster shots are likely going to be a yearly reoccurrence for the general population. But we may continue to see ebbs and flows in the economy as the viral outbreaks ascend and recede, themselves. Everyone should consider getting vaccinated if they are able to do so. But unfortunately, this looks like it’s a long-term issue we deal with like seasonal flu except on a bigger scale. Until herd immunity is reached, if it can be reached, we will have to accept waves in both the coronavirus and the economy.

As a reference, I have included my previous write up from January 2020. Feel free to laugh and cry with me.

Sources:

1. Donald G. McNeil Jr. (16 December 2015). “Fewer Ebola cases go unreported than thought, study finds” The New York Times. Retrieved August 3, 2021 https://www.nytimes.com/2014/12/16/science/fewer-ebola-cases- go-unreported-than-thought-study-finds-.html

2. “CDC H1N1 Flu | Influenza Diagnostic Testing During the 2009–2010 Flu Season”. www.cdc.gov. Retrieved 4 April 2020.

3. “Summary of probable SARS cases with onset of illness from 1 November 2002 to 31 July 2003”. World Health Organization. 21 April 2004. Archived from the original on 19 March 2020. Retrieved 4 February 2020.

4. FactSet Research Systems. (n.d.). SPY: Interactive Charting. Retrieved August 3, 2021, from FactSet database.

5. FactSet Research Systems. (n.d.). Lumber futures: Interactive Charting. Retrieved August 3, 2021, from FactSet database.

6. Times of India. “The chips are down: why there’s a semiconductor shortage” Published August 1, 2021. Retrieved from https://timesofindia.indiatimes.com/business/international-business/the-chips-are-down- why-theres-a-semiconductor-shortage/articleshow/84938991.cms

7. David Roos. “Why the 1918 flu pandemic never really ended.” The History Channel. December 11, 2020. Retrieved from https://www.history.com/news/1918-flu-pandemic-never-ended

8. Sara Reardon. “How the delta variant achieves its ultrafast spread.” Nature. July 21, 2021. Retrieved from https://www.nature.com/articles/d41586-021-01986-w

9. Google. Search term: “Worldwide Vaccinations”. Our World in Data. Last updated August 1, 2021. Retrieved August 3, 2021 from https://www.google.com/search?q=worldwide+vacinations&rlz=1C1GCEB_enUS952US952&oq=worldwid e+vacinations&aqs=chrome..69i57.4992j0j7&sourceid=chrome&ie=UTF-8

10. U.S. Bureau of Economic Analysis, Gross Domestic Product [GDP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDP, August 18, 2021.

Sometimes, investing can be cold-hearted. With the outbreak of the coronavirus in Wuhan China, there are thousands of lives at risk which makes objective investing difficult and melancholy. The reaction from the media exacerbates the problem as well, stoking fear across the world. But, as always, we must separate the investment decisions from the fear in order to achieve total return.

First, a little background on the coronavirus. Coronavirus is not the actual name of the virus but its family. The technical name is 2019-nCoV for 2019 novel Coronavirus. Coronavirus’ are fairly common and most are not infectious. Some are fairly infamous like Middle Eastern Respiratory Syndrome (MERS) and Severe Acute Respiratory Syndrome (SARS, 1). Both, like the Wuhan virus, are highly contagious and cause severe illness specifically affecting older and younger populations. 2019-nCoV, thus far, seems to be more contagious than the standard Influenza virus albeit less deadly (2).

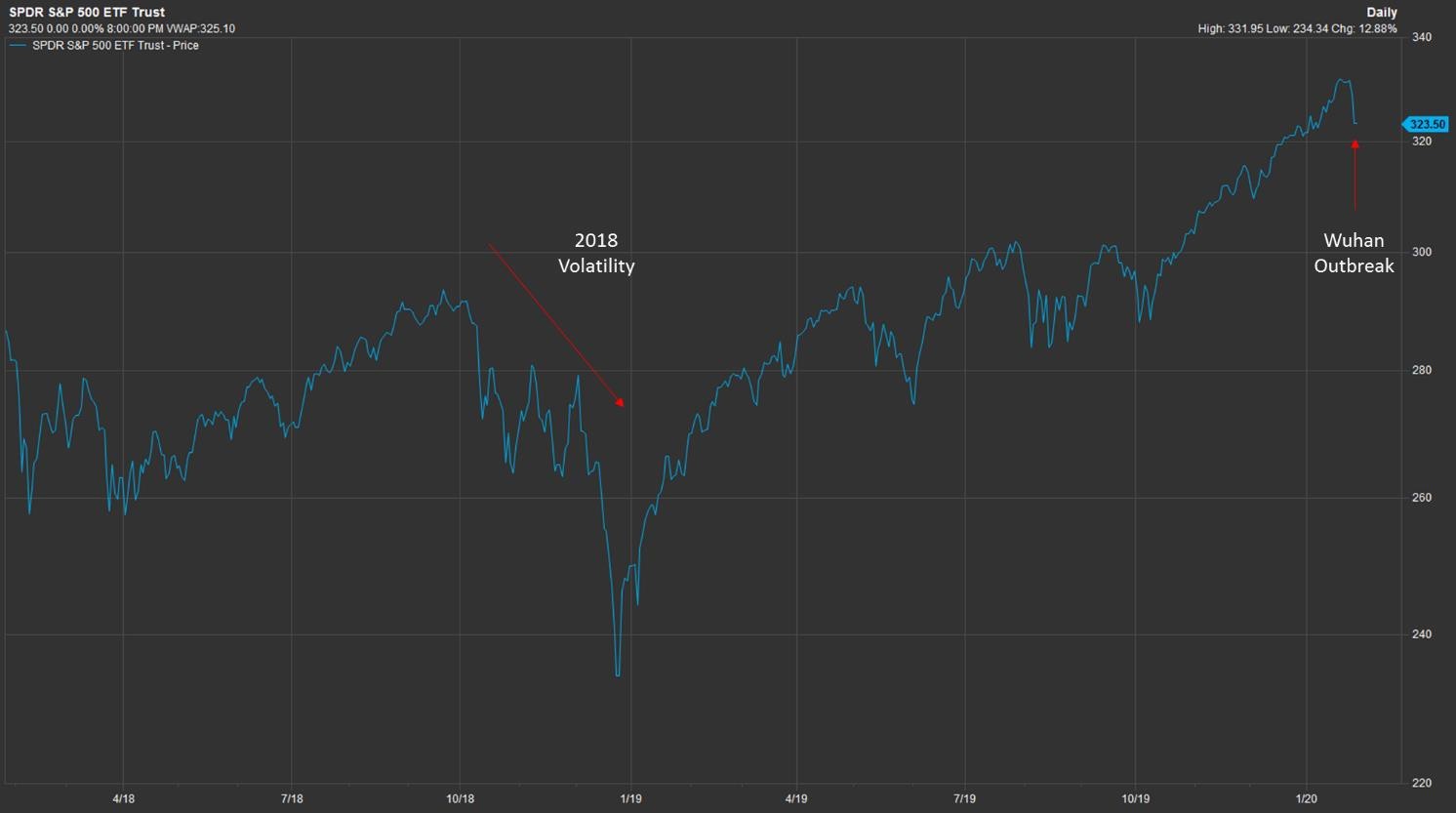

The stock market has responded negatively to the news of a novel virus outbreak. The damage to domestic markets has been limited, thus far, as the S&P 500 has only fallen 2.5% as of January 27, 2020. Comparatively, the MSCI-China index has fallen 5.3% (3). Just to put the stock market fall in perspective, I have included the 2018 decline in the following graph.

Source: FactSet.

Looking back at previous epidemic scares, we typically see a strong period of stock market declines and volatility followed by a rapid recovery. Unless there is a serious pandemic that completely shuts down worldwide travel, a viral outbreak is unlikely to have a significant economic impact.

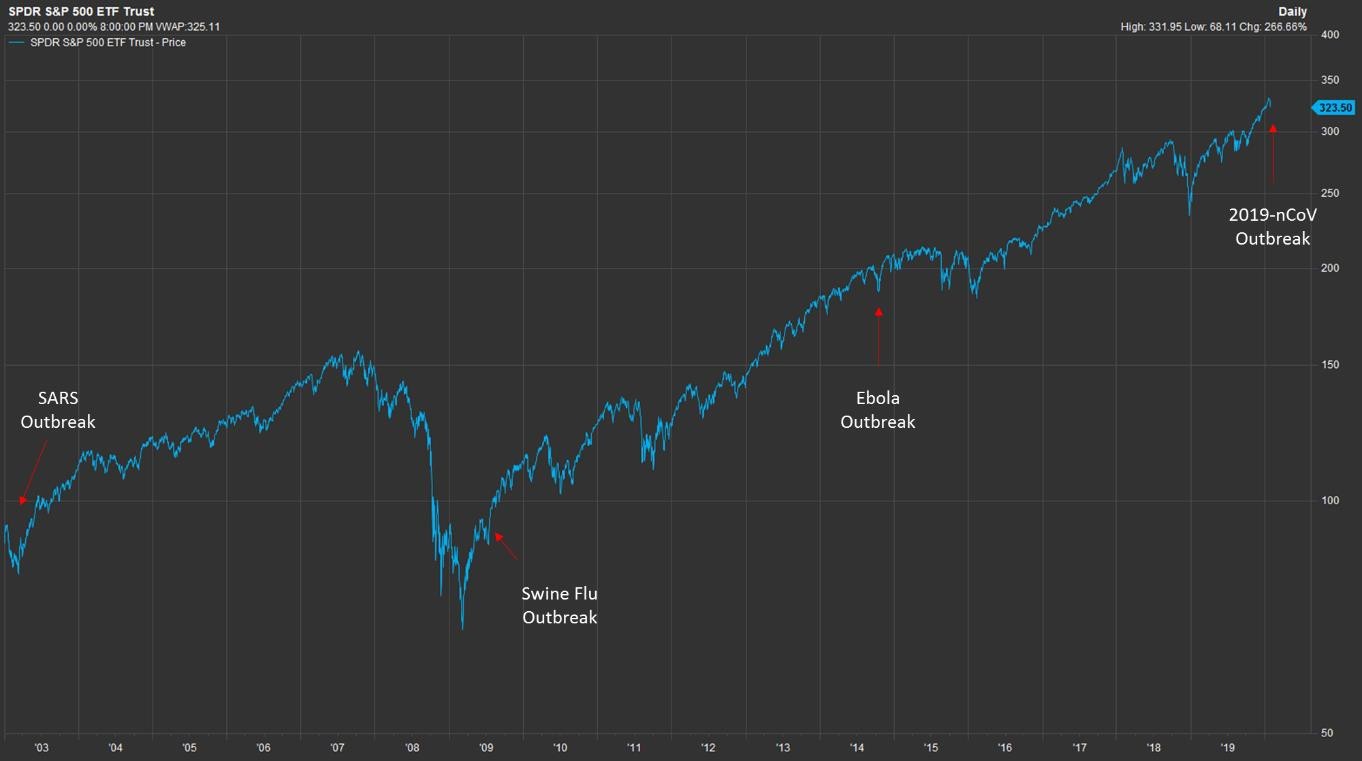

Here is the 2014 Ebola scare:

Source: FactSet.

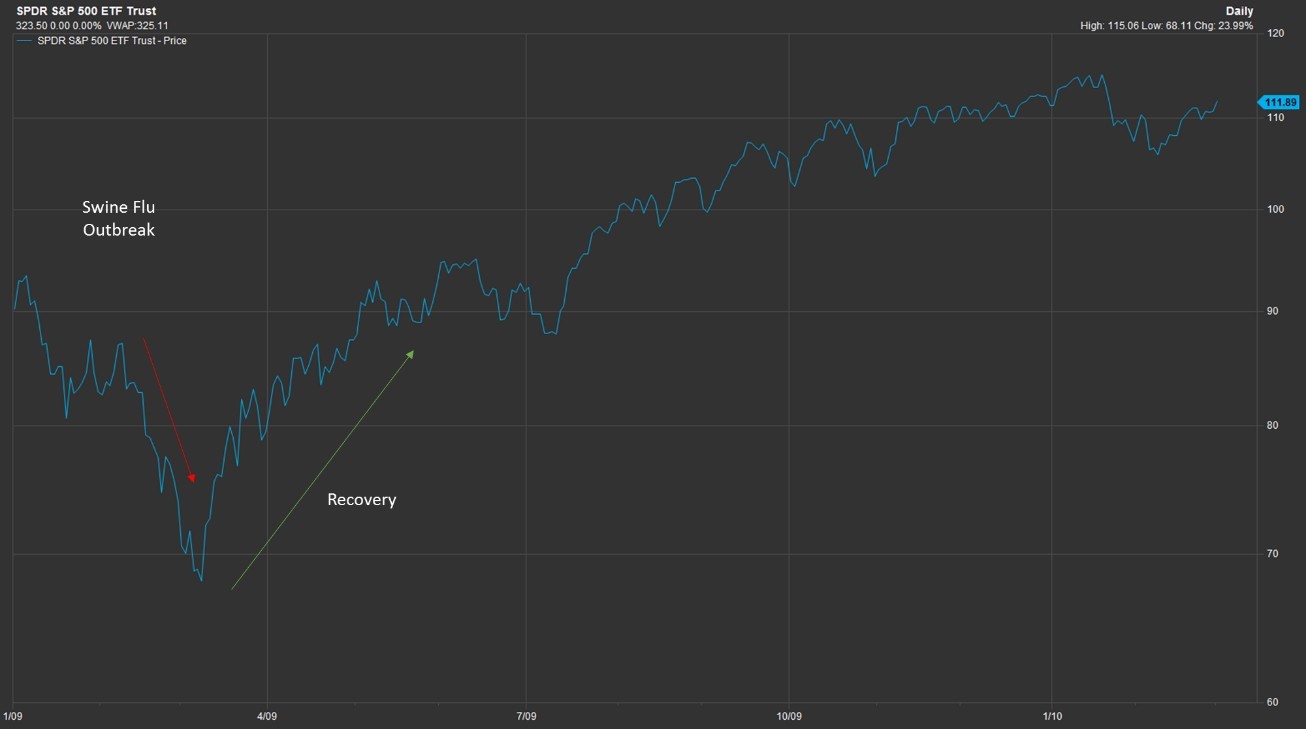

2009 Swine Flu:

Source: FactSet.

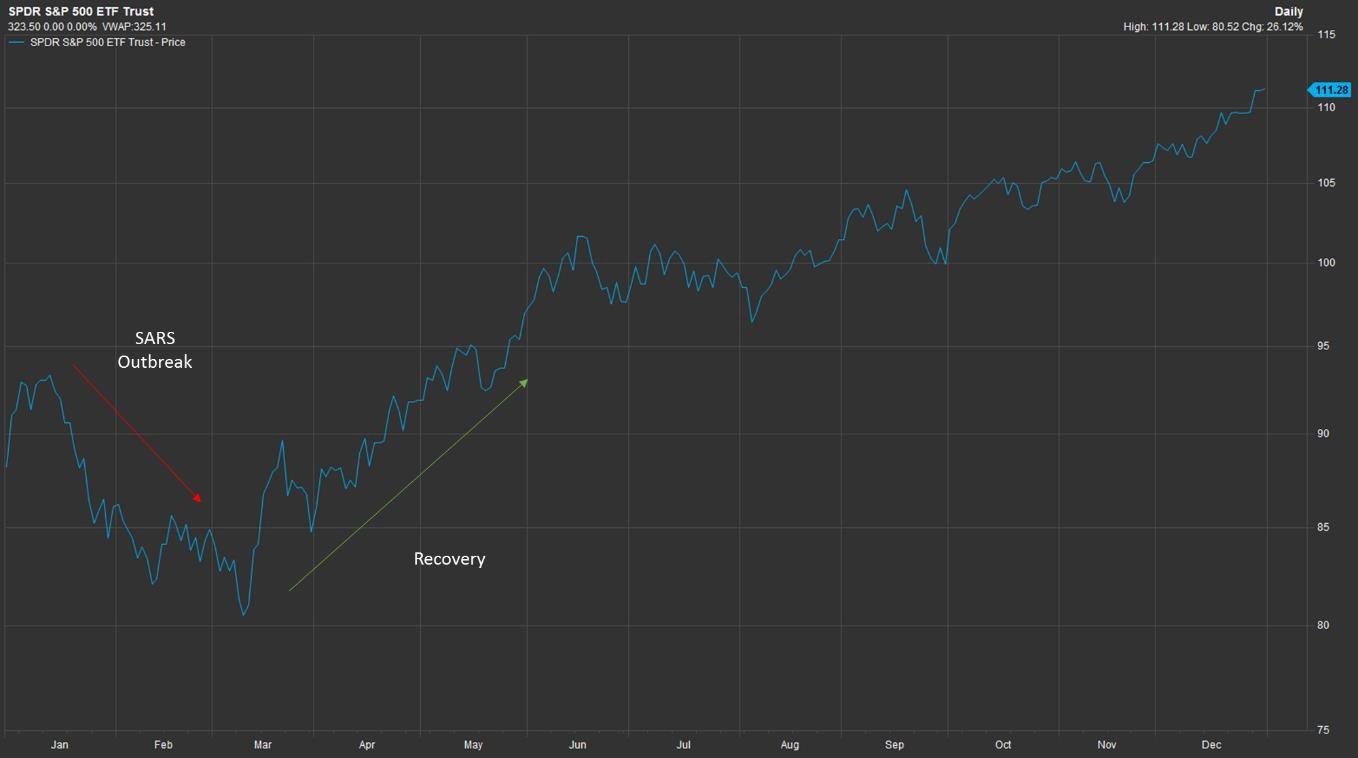

2003 SARS outbreak:

Source: FactSet.

And if you put it all together over a 15-year period, you can barely see any of these outbreaks over a long time frame indicating that even the most severe epidemics have little impact on the economy.

Source: FactSet.

The point is this: there is no reason for investors to panic. The modern-day epidemiological control mechanisms far exceed the capabilities in 1918 when the Spanish Flu circumnavigated the globe. The Chinese, the CDC, and the World Health Organization are fully capable of controlling this epidemic. And the economy simply doesn’t respond to any outbreak short of a global catastrophe. Including seasonal flu which infects 10m-45m people a year, killing 12,000-61,000 people annually (4). Therefore, clients should not worry about the effect Wuhan Coronavirus has on their investments.

But given that human lives are at risk, it’s worth taking a moment to see how we can protect ourselves. For more information on that, please visit this CDC website:

https://www.cdc.gov/coronavirus/2019-ncov/about/prevention-treatment.html

Brian Ransom, MBA, MS Research Director

Signature Wealth Management Group

Sources:

1. Centers for Disease Control and Prevention. (2020). Coronavirus. Retrieved from https://www.cdc.gov/coronavirus/2019-ncov/index.html

2. Biggerstaff M, Cachemez S, Reed C, Gambhir M, Finelli L. “Estimates of the reproduction number for seasonal, pandemic, and zoonotic influenza: a systematic review of the literature.” PubMed September 4, 2014. Retrieved from https://www.ncbi.nlm.nih.gov/pubmed/25186370

3. FactSet Research Systems. (n.d.). SPY: Interactive Charting. Retrieved January 28, 2020, from FactSet database.

4. Centers for Disease Control and Prevention. (2020). Disease Burden of Influenza. Retrieved from https://www.cdc.gov/flu/about/burden/index.html

All expressions of opinion reflect the current opinion of the author and are subject to change. This material is for informational or educational purposes only. Information contained herein has been derived from sources believed to be reliable but is not guaranteed as to accuracy. Past performance may not be indicative of future results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The MSCI China Index captures large and mid cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs). With 703 constituents, the index covers about 85% of this China equity universe. Currently, the index includes Large Cap A and Mid Cap A shares represented at 20% of their free float adjusted market capitalization.