Fact Of The Week 25 May 2022 | US Birth Rate

U.S. births increased in 2021 for the first time in 7 years as a result of the pandemic DID YOU KNOW? U.S. births increased for the first time since 2014. Source: Wall Street Journal This material is for informational or educational purposes only. Signature Wealth Management Group is registered as an investment adviser with the SEC. Signature Wealth Management Group only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Investing involves risk [...]

Fact Of The Week 18 May 2022 | Increase in Average Hourly Earnings

Since the start of the pandemic, average hourly earnings have increased significantly. DID YOU KNOW? Since Feb 2020, nominal US average hourly earnings have increased 11.5%. Source: Compound Capital Advisors This material is for informational or educational purposes only. Signature Wealth Management Group is registered as an investment adviser with the SEC. Signature Wealth Management Group only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Investing involves risk including the potential loss [...]

Fact Of The Week 11 May 2022 | Retirement Age

Are you taking the right steps to be able to retire on time? DID YOU KNOW? Since the mid 1990s, the average retirement age for both men and women has increased by 2 years. SOURCE: CENTER FOR RETIREMENT RESEARCH AT BOSTON COLLEGE This material is for informational or educational purposes only. Signature Wealth Management Group is registered as an investment adviser with the SEC. Signature Wealth Management Group only transacts business in states where it is properly registered, or is excluded [...]

Fact Of The Week 4 May 2022 | Technology Stocks

Technology stocks were hit especially hard in April. Contact us to see what this means for your retirement portfolio. DID YOU KNOW? April 2022 was the worst month for the Nasdaq Composite Index since 2008. SOURCE: WALL STREET JOURNAL This material is for informational or educational purposes only. Signature Wealth Management Group is registered as an investment adviser with the SEC. Signature Wealth Management Group only transacts business in states where it is properly registered, or is excluded or exempted from registration [...]

Fact Of The Week 27 April 2022 | Mortgage Payments

With increasing interest rates and housing prices skyrocketing, mortgage payments are up at historical rates. DID YOU KNOW? Mortgage payments have increased by 37.8% Year over Year. SOURCE: REDFIN ANALYSIS OF MLS DATA, FREDDIE MAC PRIMARY MORTGAGE MARKET SURVEY This material is for informational or educational purposes only. Signature Wealth Management Group is registered as an investment adviser with the SEC. Signature Wealth Management Group only transacts business in states where it is properly registered, or is excluded or exempted from registration [...]

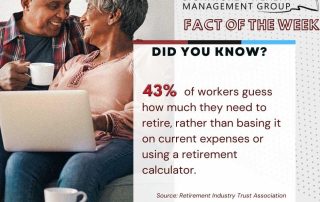

Fact Of The Week 20 April 2022 | Calculate Your Retirement

Have you taken the time to properly plan and calculate your retirement? Reach out to us for assistance! FACT OF THE WEEK 43% of workers guess how much they need to retire, rather than basing it on current expenses or using a retirement calculator. Source: Retirement Industry Trust Association This material is for informational or educational purposes only. Signature Wealth Management Group is registered as an investment adviser with the SEC. Signature Wealth Management Group only transacts business in states where it [...]

Fact Of The Week 13 April 2022 | Bond Funds Underperforming

Bond funds have been significantly underperforming in 2022, contact us to learn more about what you can be doing with your fixed income. DID YOU KNOW? If the year ended today, it would be the worst in history for the US Bond Market with a loss of over 8% YTD. SOURCE: BLOOMBERG US AGG BOND INDEX, COMPOUND CAPITAL ADVISORS This material is for informational or educational purposes only. Signature Wealth Management Group is registered as an investment adviser with the SEC. [...]

Fact Of The Week 7 April 2022 | Change in Household Net Worth

Total change in household Net Worth increased for the third consecutive year, marking the largest year over year increase in history. FACT OF THE WEEK The Net Worth of US households increased by $18.2 trillion in 2021, which is the largest increase in history. SOURCE: FEDERAL RESERVE , COMPOUND CAPITAL ADVISORS This material is for informational or educational purposes only. Signature Wealth Management Group is registered as an investment adviser with the SEC. Signature Wealth Management Group only transacts business in states where [...]

Fact Of The Week 30 March 2022 | Fiscal & Monetary Policies

Due to a combination of fiscal and monetary policies since the onset of the pandemic, the US M2 Money Supply 2-year change is at an all-time high. DID YOU KNOW? The US Money Supply has increased 41% in the last 2 years, which is the largest 2-year increase in history. Source: US M2 Money Supply , Compound Capital Advisors This material is for informational or educational purposes only. Signature Wealth Management Group is registered as an investment adviser with the SEC. Signature [...]