July 1, 2022

Market Update: July 1, 2022

Welcome to the weekly market update from Signature Wealth Management. I’m Brian Ransom, Research Director from Signature Wealth and here’s what happened in the market this week.

Typically, I’m doing this weekly market update via video. But this week, I’ve caught COVID and have trouble getting out 3 sentences without my voice cracking. I am in good health and rapidly improving so no worries there. But in the meantime, you’ll just have to read rather than watch the Weekly Market Update.

The S&P 500 had a reasonable 6.2% rally off the bottom on June 17 but has since reversed course and could test that bottom very soon. For now, the downward trend for 2022 continues.

With the second quarter closing out with a 21% loss in the S&P 500, some investors are under the assumption that we are already in a recession and others believe that we will be shortly. The debate over whether we’re in a recession or not is irrelevant. What matters how much deeper can losses get and how long does it last?

“History doesn’t repeat itself but it does rhyme.” – Mark Twain

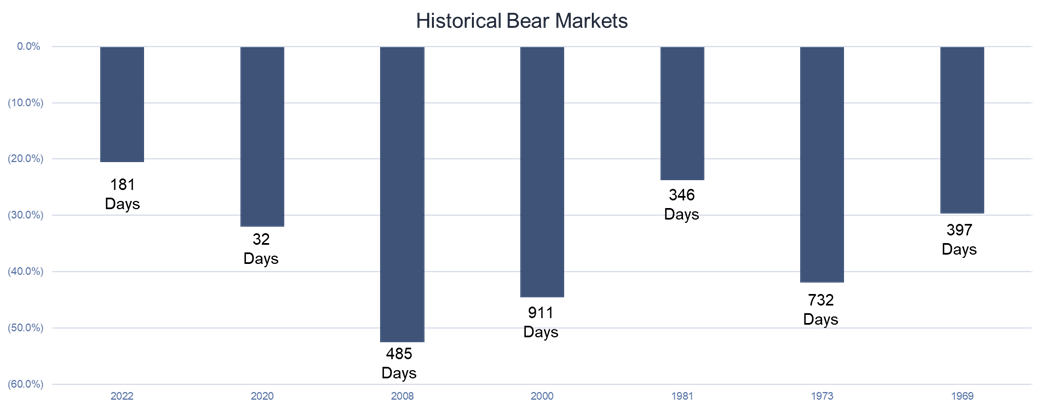

Here’s a look at a few of the past bear markets. They vary significantly is depth-of-loss and length. But context matters. I do not view the 485-day, 55% loss from the Global Financial Crisis as relevant. Banks are not taking excess risk, there is no liquidity crisis, and housing is not propped up by bad loans. Could the market decline another 30% over the next year? Sure, but losses that large are almost always caused by issues with our financial system, which at this moment are not showing signs of cracking.

I would also rule out the elongated 1973 decline. The 10-year treasury was near 8%, unemployment was near 6%, and the US was under an oil embargo. A lot has to change for that comparison to become relevant.

The Dotcom bubble of 2000 could be fairly relevant. Leading up to the 2022 bear market, excesses in valuations were prominent in the stock market albeit to a much lesser extent than the Dotcom bubble. Furthermore, inflation was not an issue during the Dotcom nor were there bond sell-offs. So while there are echoes of the Dotcom, it’s not a perfect comparison.

Which leads us to 1981 and 1969, both of which lasted about a year with approximately 25% and 30% declines, respectively. We’re already at a 21% decline, so we’ve already experienced almost all of the pain equivalence for these two bear markets regardless of whether we’re in a recession now or will be in a recession in the near future!

Data pulled from Factset Database

Remember, the market is not the economy. A “recession” is a reflection of the economy, not necessarily the market. Markets tend to bottom before a recession is over, thus selling out of fear of a recession following a 21% pullback risks selling right at the bottom, locking in losses. This is a common mistake average investors make where short term pain trumps long term gains.

Sincerely,

The Signature Wealth Management Team

Sources:

- FactSet Research Systems. (n.d.). S&P 500 (Interactive Charts). Retrieved July 1, 2022, from FactSet Database.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Information is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

Neither the named representative nor Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your tax professional for specific guidance.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.