December 30, 2021

The Secretly Best Time To Invest

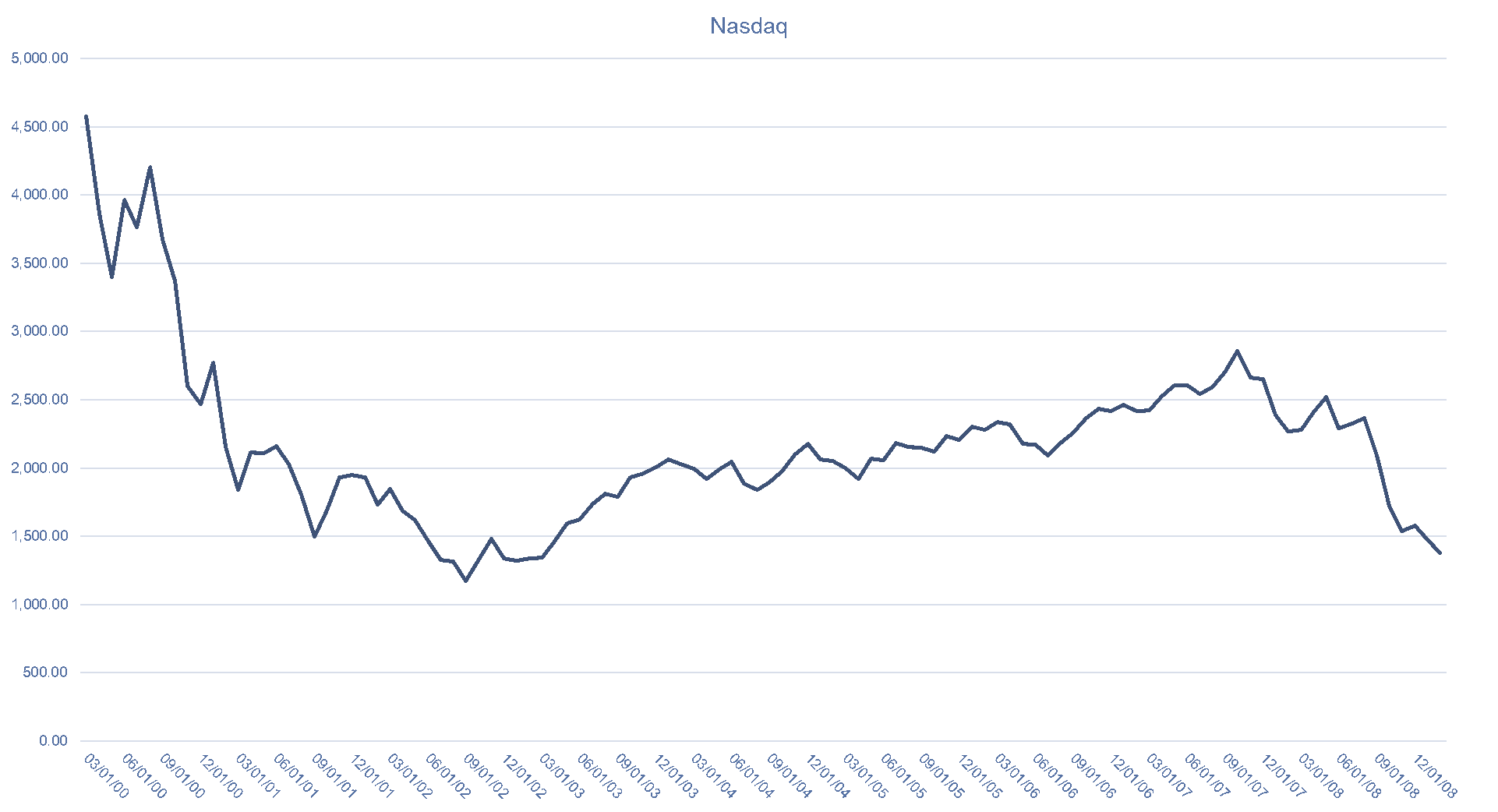

The time period between the peak of the Dotcom Bubble in 2000 and the bottom of the Global Financial Crisis (GFC) in 2009 is widely considered the worst period of investment returns since the Great Depression. During that time period, the Nasdaq Composite lost nearly 70% of value and the economy is still reeling from the consequences of the GFC today. Common sense would say that investing at the top of the Dotcom Bubble would be a terrible decision, right? Well, it actually depends on how you invest.

If you invest $262,000 on March 31, 2000, you would have $78,943 on February 27, 2009. That would eventually recover to $905,688 as of December 28, 2021 with an 246% cumulative return, if you were patient enough to hold for that long, resisting all temptation to sell during a decade of pain.

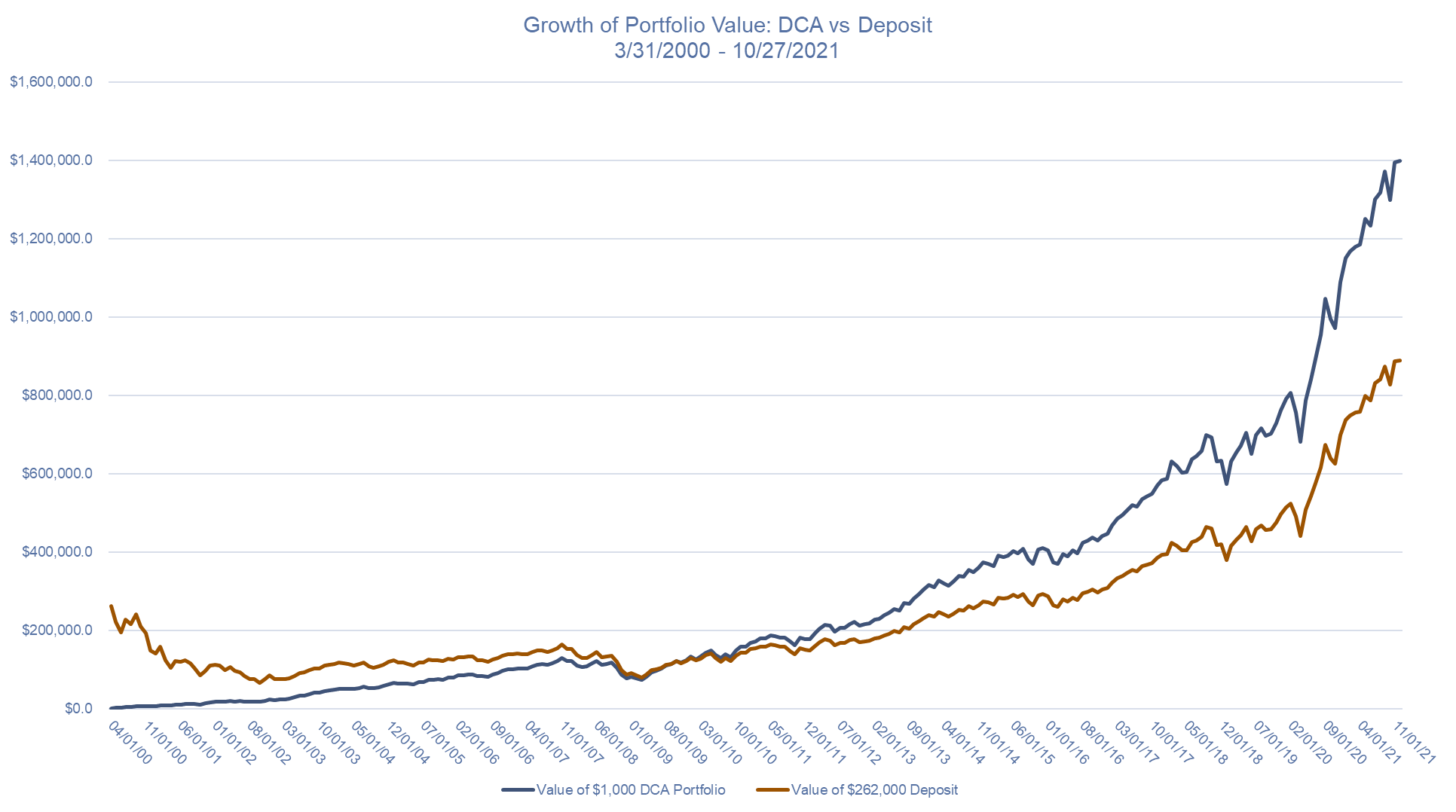

However, most investors don’t just invest their entire life savings all at once. Most gradually build their wealth over time in IRA’s, 401(k)’s, or 403(b)’s. So instead of investing all $262,000 all at once, let’s assume the investor deposits $1,000 per month for the 262 months between March 31, 2000 and the end of 2021. This is called a Dollar Cost Average (DCA). Despite the principal value remaining the same, long term returns in a $262,000 DCA outpace the returns of a $262,000 deposit during this time period.

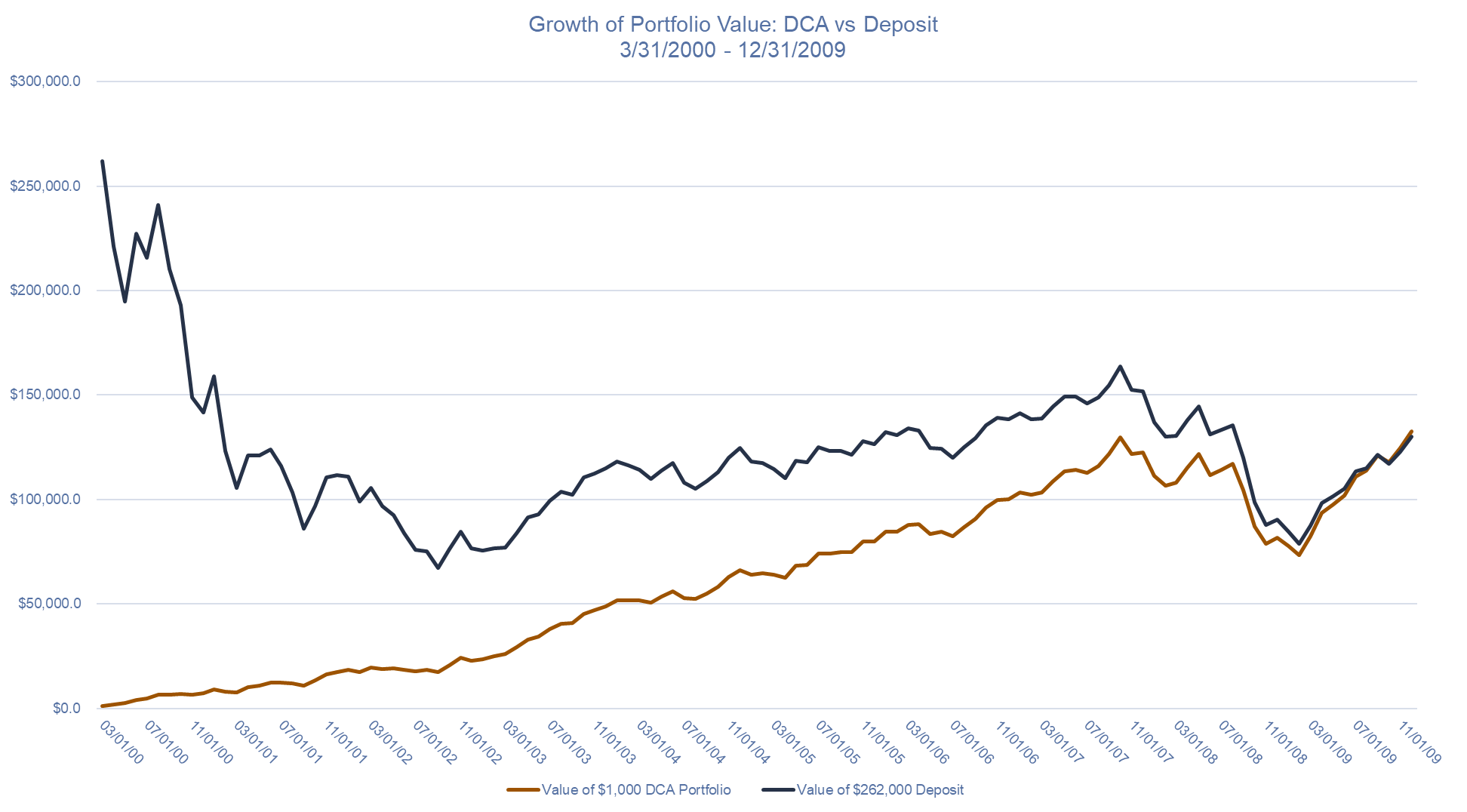

Here’s a closer look of that early time period between the Dotcom and the Global Financial Crisis. Keep in mind that both portfolios experience the exact same returns but the DCA portfolio disperses the deposits, avoiding the raw dollar drawdown of the total portfolio.

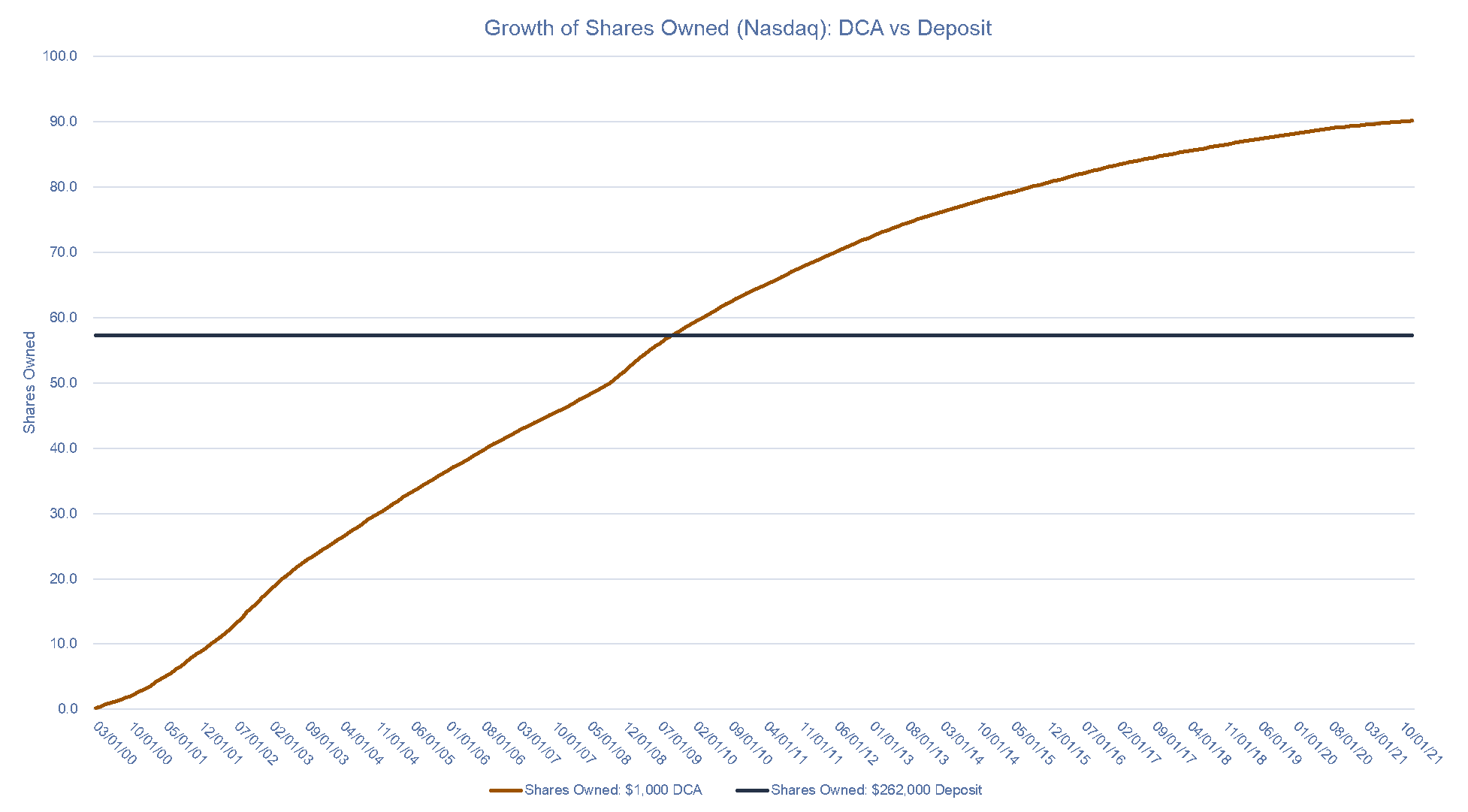

This is because the initial DCA does not experience the full drawdown of the Dotcom bubble and only part of the GFC. This allows the consistent $1000 purchases to buy more shares of the index at a cheaper price. While the $262,000 deposit immediately purchases 57 shares of the index in 2000, the $1000 deposit eventually catches up to and surpasses the total number of shares owned.

Now, this time period is very much “cherry-picked.” If the investor made the large deposit right at the bottom of the Dotcom or the Global Financial Crisis, this experiment would look very different. But the cherry-picked time period demonstrates a simple concept. Young investors making periodic deposits into their investment accounts should be more concerned about the consistency of those deposits than the returns of the market itself. A 70% pullback in the market on a $1,000 portfolio means very little in the grand scheme of things if the DCA deposits are consistent. In other words, that’s a $700 loss that is immediately recovered by another $1,000 deposit. Young investors want a market pullback so they can buy more shares at cheaper prices.

Sources:

- FactSet Research Systems. (n.d.). Nasdaq Composite (Price History). Retrieved December 29, 2021, from FactSet Database.

Nasdaq (National Association of Securities Dealers Automated Quotations) is a global electronic marketplace for buying and selling securities.

This material is for informational or educational purposes only.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

Consult your financial professional before making any investment decision.