March 2, 2022

The Kindling for the Inflation Fire | Global Financial Crisis

There are three “components” to building a fire. First, you need fuel: wood, gas, paper, etc. The fuel burns and sustains the fire after it has been lit. Second, you need oxygen. No fire can ever burn without oxygen. Finally, you need “spark”. This essentially boils down to the temperature reaching the required level for ignition to occur. A careful combination of these three essential ingredients determines the difference between a warm campfire and a full-blown, out-of-control fire.

Heading into the summer of 2021, the entire world economy set the stage for the largest inflationary spike since the great inflationary years of the 1970’ and 1980’s.

Source: Trading Economics

Following the spike, central bankers, economists, and arm-chair policy makers alike argued the exact cause of the spike whether it be a massive influx of money supply, excessive spending from the federal government, supply chain issues, or a surge in spending from the consumer. None of these theories fully encompass the truth, however, because the answer isn’t any one cause. It’s a combination of events that lit the metaphorical inflating economy on fire.

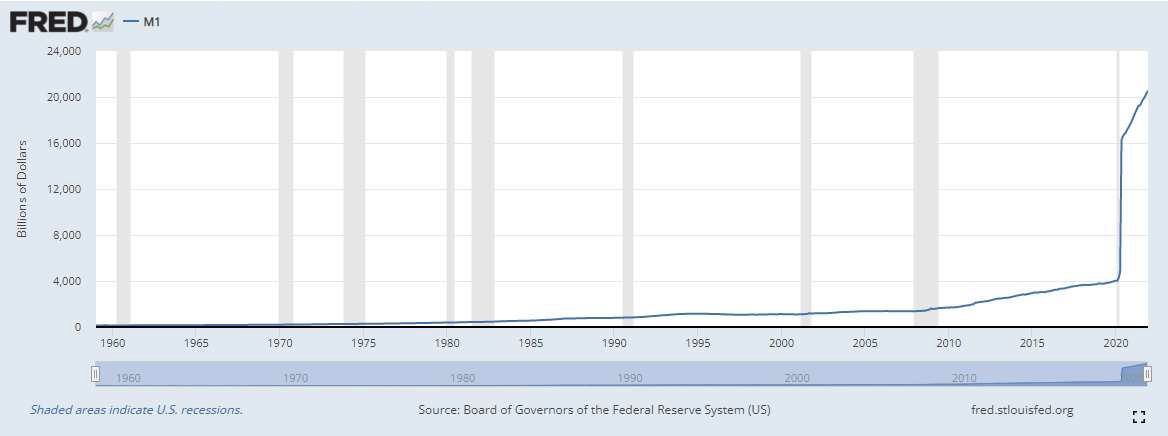

For a fire to burn, you need something to fuel that burn. In this case, it’s the money supply. Beginning in the Spring of 2020, the Federal Reserve opened the spigots to the money supply, cut the Fed Funds Rateto 0% and bought roughly $5 trillion worth of bonds, adding that cash to the money supply. The M1money supply, the measure of liquid dollars in the economy, subsequently spiked. This graph needs a caveat, though. Beginning in May of 2020, the Federal Reserve began counting demand deposits which caused the initial massive spike. Thereafter, though, the growth in the M1 money supply is fueled by monetary policy from the Federal Reserve.

Source: FRED

The money supply is the fuel needed to burn the inflation fire. Without the money supply, the fire would be small and likely fizzle out. Ask any pyromaniac, though, what happens to a fire when you add large logs or even a splash of gasoline? It’s obviously going to burn hotter, and for longer. But a pile of sticks, by themselves, don’t catch flame.

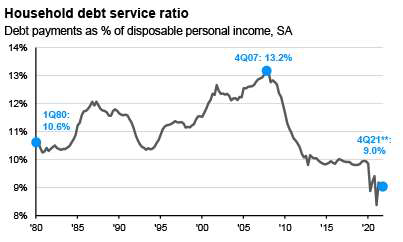

Next, we need oxygen, the frequently forgotten yet necessary aspect to fire building. With economics, the oft overlooked yet imperative oxygen equivalency to the inflation equation is consumer spending. Driving that spending is first the economic health of the average consumer and second, growing wages. The average household debt-service ratio (debt payments as a percentage of disposable personal income) has fallen dramatically since the peak during the Global Financial Crisis.

Source: JP Morgan Guide to the Markets

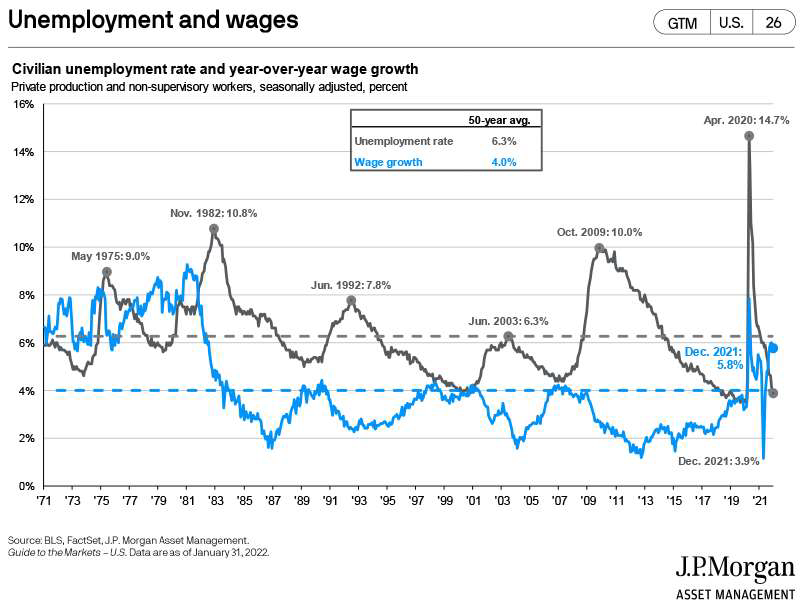

Likewise, wage growth has been steadily rising since 2013 and spiked significantly in 2020 and 2021.

Source: JP Morgan Guide to the Markets

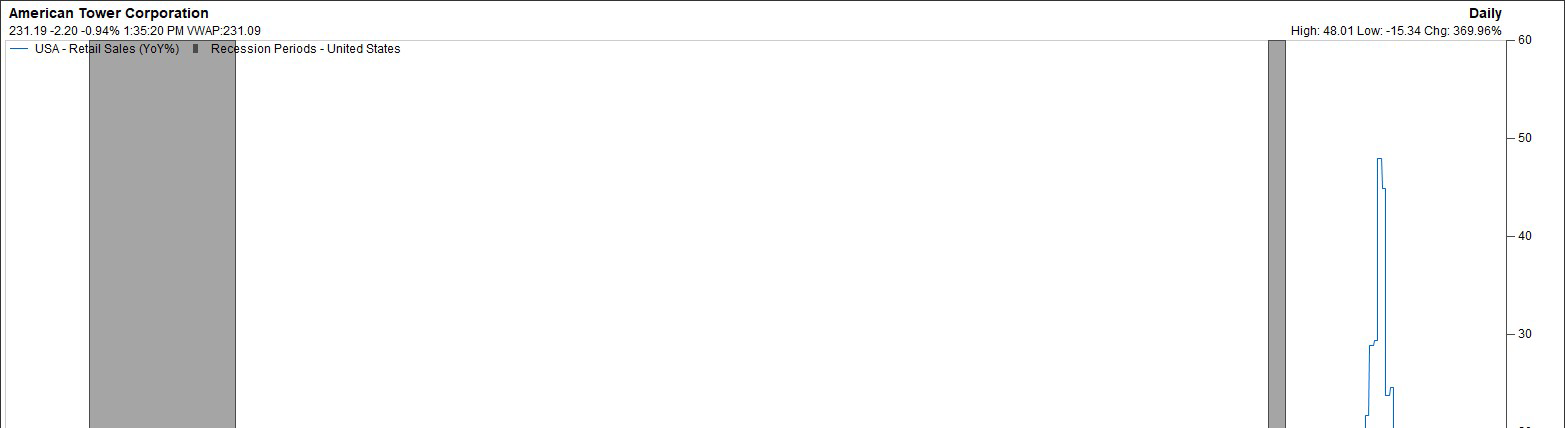

Rising wages and a strong consumer balance sheet has led to retail spending growth at a rate much higher than the historical average. Retail spending growth means higher demand for retail products. Higher demand means higher prices, which ultimately drives inflation.

Source: FactSet Interactive Charts

This is the phenomenon that drove much of the inflation in the 1970’s and 1980’s; a Baby Boomer generation emerging into their prime spending years with higher wages, spending their newly found disposable income, driving prices higher. This is the oxygen that feeds the long-term inflation fire, allowing it to burn hotter and higher.

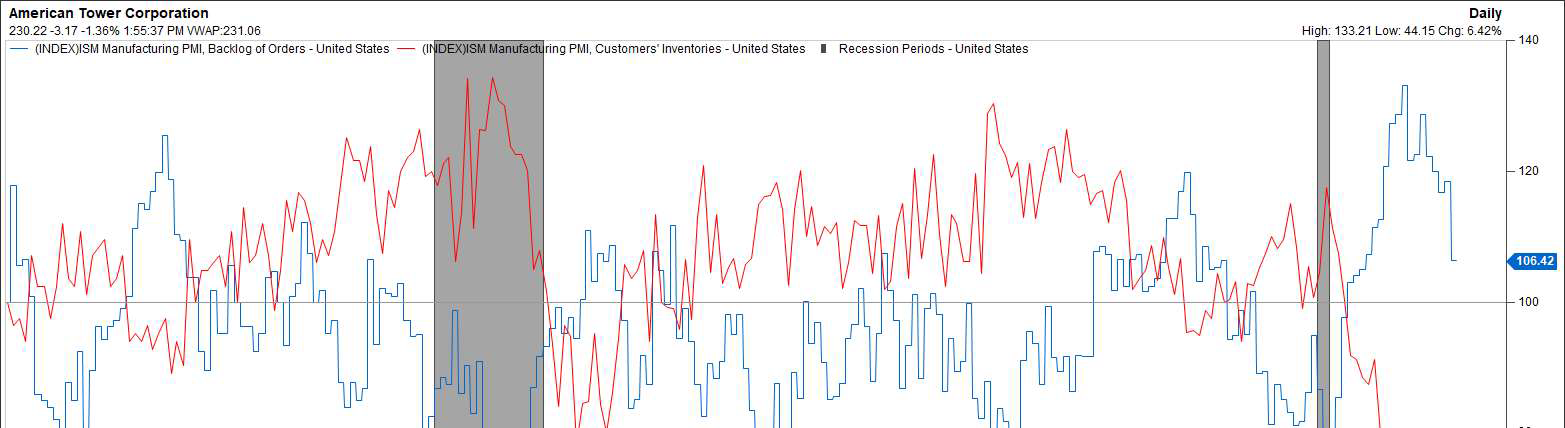

Still, a pile of wood with plenty of access to oxygen, by itself, will never set fire. To light our pile of metaphorical money supply, that required a spark that came in the form of Covid-19 and the subsequent supply constraints (and now, possibly, a war in Eastern Europe). With the onset of the pandemic, it became difficult to ship goods in a global economy partially locked down. This caused a dramatic supply constraint that forced manufacturers to consume their inventory and build up backlogs. This dynamic can be seen below with inventory in red and order backlogs in blue. In a normal economy, those two lines are supposed to move in conjunction. Covid forced the disconnect seen in 2020 and 2021.

Source: FactSet Interactive Charts

As inventories and subsequent new supplies become scarce, prices tend to rise. Consumers notice those price increases. On top of that, for the first time in a few decades, the average household now has the capacity to spend. If the average consumer with spending capacity believes that forward-looking prices will be higher than today’s prices, then that consumer will buy now, causing a self-fulfilling prophecy of rising prices. This well-documented phenomenon is the primary driver of inflation.

Notice, in the graph above that inventories and backlogs started to recover in the middle of 2021. Supply chains have been easing for some time now. But at this point, the driver of inflation is no longer supply chains, it’s consumers buying goods at unusually high numbers with the excess dry powder they currently have. In other words, once the fire is lite, the spark is no longer needed to maintain the burn.

To summarize, Covid-19 induced supply chain constraints was the spark that lit the fire of consumer spending with excess money supply fueling the growing inflation fire. Importantly, it is critical that the fire not be snuffed out. A small level of inflation (1.5-2.5%) is indicative of a healthy, growing economy. The safest way to reduce the temperature is simply quit feeding the fire with more fuel from the money supply. This is exactly what the Federal Reserve is doing right now. They’re raising interest rates and stopping their quantitative easing. Both actions reduce the money supply and hopefully, bring the heat down just a little bit.

Sincerely,

The Signature Wealth Management Team

3625 Cumberland Blvd. SE • Suite 1485 • Atlanta, GA 30339 • 678.932.2500

Sources:

1. Trading Economics. “The United States Inflation Rate.” Retrieved February 28, 2022 from

2. Board of Governors of the Federal Reserve System (US), M1 [M1SL], retrieved from FRED,

Federal Reserve Bank of St. Louis, February 28, 2022.

3. J.P. Morgan Asset Management. “Guide to the Markets.” 1Q 2022 as of January 31, 2022.

4. FactSet Research Systems. (n.d.). USA Retail Sales (Interactive Charts). Retrieved February 28, 2022.

5. FactSet Research Systems. (n.d.). Manufacturing PMI, Backlog of orders & Manufacturing PMI

Customers Inventories (Interactive Charts). Retrieved February 28, 2022.

Disclosures:

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer

goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each

item in the predetermined basket of goods and averaging them. Changes in the CPI are used to assess price

changes associated with the cost of living. The federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Diversification does not guarantee profit nor is it guaranteed to protect assets. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Information is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Neither the named representative nor Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your tax professional for specific guidance.