December 23, 2021

Holiday Traditions in Market Predictions

Holiday Traditions in Market Predictions

Brian Ransom, MBA, MS

Research Director

Signature Wealth Management Group

It’s the end of the year and thus begins the many holiday traditions surrounding the year end: decorating Christmas trees, visiting family, gluttonous amounts of overeating, futile predictions of next year’s market returns.

While that last one may not be a common in your household, every year equity market analysts gather like Christmas elves to regress economic output, sum up all the parts, revert their returns to the mean, and churn out a predictably incorrect prognostication on next year’s returns. We don’t fault them though. It is an incredibly difficult job akin to rocket science except gravity is constantly fluctuating.

There are two distinct problems with predicting market returns on a calendar year. First, the markets don’t really care what year it is. There is no distinct separation between two years and returns are continuous. So, it’s a mistake to pretend that returns follow the same pattern as a new year’s resolution.

More importantly, humans are highly susceptible to what’s called the “availability bias.” This is a cognitive bias that anchors your brain to the most readily available information. In this case, the returns you just received on the previous calendar year. It is all too easy to tune out all the available data and predict more of the same for the next calendar year.

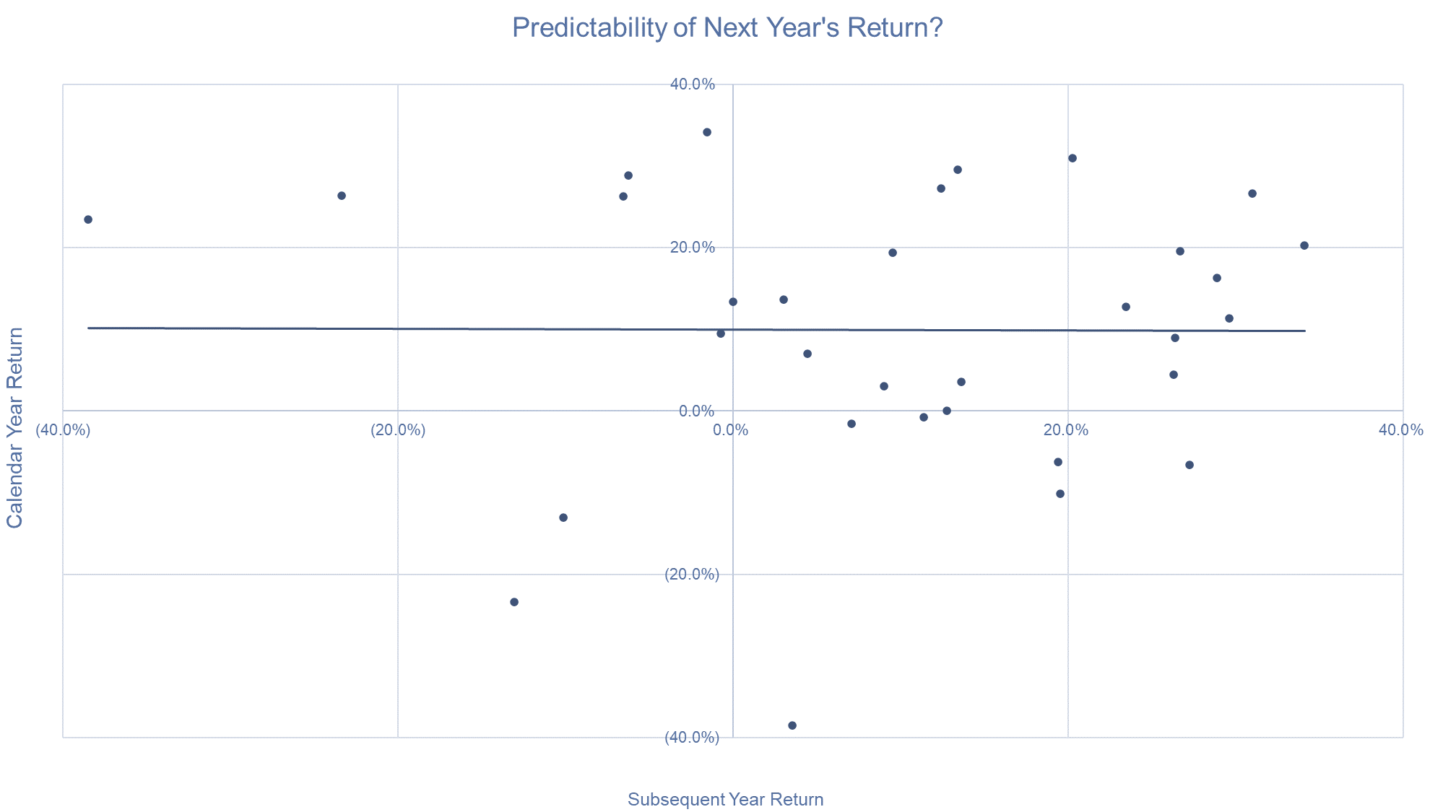

This would be a statistical mistake. Previous calendar year returns are incredibly poor predictors of subsequent calendar year returns as seen in the graph below. This is a regression of current year returns vs the subsequent returns for the following year. If you don’t see a pattern, that’s because there is none. Meaning, there is no predictability of returns from year to year and the previous year’s returns has little influence on next year’s returns. For those statistics geeks out there, the R-squared of this regression is .0000317 or roughly the predictability of a weatherman on future lottery winners.

So, as you may be reading market predictions for 2022 along with your Christmas cards, don’t forget to put it into context. It’s incredibly difficult to predict year end targets for the market nor should you fret about the prognostication from Person XYZ on Channel 123. It spoils the holiday cheer.

Source:

- FactSet Research Systems. (n.d.). S&P 500 (Interactive Charts). Retrieved December 14, 2021, from FactSet Database.

This material is for informational or educational purposes only.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

Consult your financial professional before making any investment decision.

R-Squared is a statistical measure of fit that indicates how much variation of a dependent variable is explained by the independent variable(s) in a regression model. R-squared is generally interpreted as the percentage of a fund or security’s movements that can be explained by movements in a benchmark index.