July 22, 2021

Exploring the Implications of Restricted Stock Units

Exploring the implications of Restricted Stock Units on #taxes #compensation #wealthmanagement #SignatureWMG

In the corporate world, there are a lot of unique compensation packages that include more than just the standard salary, insurance, paid leave, and 401(k) and/or pension. These packages present their own unique challenges for employees to properly manage their benefits. Improper planning can lead to unnecessary tax events, a mismatch in retirement needs to asset levels, or general confusion about the salary packages and the benefits they provide.

One of the more confusing packages available to employees is the restricted stock unit (RSU). With this form of compensation, the employee is granted a stock to a publicly traded company that cannot be traded until the vestment date. Without proper management, the employee could burden themselves with unnecessary taxes and fall short of retirement goals. Some corporations like to use RSU’s as a way to supplement compensation without paying cash. These corporations tend to have a salary cap but can boost total salary above the cap through the RSU’s. For instance, an employee that would otherwise make $265,000 a year makes $165,000 in cash salary and $100,000 a year in restricted stock that can be sold during certain windows throughout the year, redeemed in cash.

But there are additional tax implications with restricted stock. For one thing, the RSU’s are a part of the employee’s income which makes it subject to income tax. The income is calculated at the time of vestment and the share price is locked in at that time. To pay the income tax, part of the RSU is withheld before the shares are granted. As an example, an employee with a $100,000 RSU bonus receiving 100 shares of XYZ stock ($1,000 per share) might only receive 80 shares at the time of vestment with the remaining 20 shares paying the income tax. Usually, the corporation will do this automatically for the employee. The employee is then free to do what they desire with the remaining 80 or so shares.

However, the tax hurdles are not yet cleared. Once those shares are sold, the employee is also subject to a capital gains tax rate. Should the employee immediately sell the 80 shares, then the capital gains taxes should be minimal because there simply isn’t enough time to generate capital gains. However, If the employee sells the shares within the first year after gains have been accumulated, then the shares are subject to a short-term capital gain tax rate. The rate is essentially your income tax rate. If the employee is in the 35% tax bracket, taxes must be paid on the difference between the price of the stock when the shares sell and when they were vested. For example, if the shares sold at a 3% increase (that’s a $30 profit on XYZ shares), then approximately $10.50 in taxes would be due per share sold. Ultimately, a tax professional should be consulted on this.

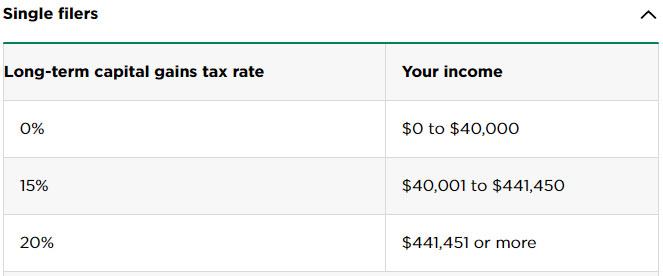

If the shares are sold a year later or more, then they’re subject to the long-term capital gain tax rate. For most people, that rate will be 15% (again, consult a tax professional). See the table below for single filers:

Source: https://www.nerdwallet.com/article/taxes/capital-gains-tax-rates (1)

In this case, if a share is sold a year later $100 higher than when it was vested, then you’re subject to $15 of capital gains taxes per share sold.

In both cases, the taxes paid is dependent upon the movement of the stock price. Even at the largest corporations in the world, the stock price can fluctuate significantly in short time periods. Once the shares vest, the stock price risk is entirely on the employee. As an example, Amazon (NASDAQ: AMZN) stock lost as much as

22% value between February 20, 2020 and March 16, 2020 (2). Other large corporations like Exxon Mobile (NYSE: XOM) lost 47% between February 20, 2020 and March 23, 2020 (3). Employees should consider the risks of these swings in share price should they need the income or the savings. Diversifying that risk away from a single stock, reducing exposure to at least 20% of the total portfolio, is the best practice.

Finally, there are variations of this type of compensation. Performance Shares are stock grants that vest once a certain financial target is met. For instance, if the corporation as a whole reaches an earnings growth goal, then the employee may receive a number of shares as compensation for reaching said goal. Many corporations also offer stock options which are only valuable above a certain price for the stock. This incentivizes employees to reach performance metrics that would boost stock price. Each type have their own tax and planning implications.

To conclude, employees with RSU’s should be careful with the management of their units both from a tax standpoint and with the volatility that comes with owning individual stock. Employees may find unpleasant surprises on Tax Day or any period of prolonged stock market volatility. To mitigate these risks, employees should consult a tax professional, an investment professional, establish a budget, and seek a financial plan to properly prepare for retirement.

Sources:

1. Orem, Tina. Nerd Wallet. “2020-2021 Capital Gains Tax Rates – and How to Calculate Your Bill.” Written November 16, 2020. Retrieved from https://www.nerdwallet.com/article/taxes/capital-gains-tax-rates.

2. FactSet Research Systems. (n.d.). Amazon (interactive charts). Retrieved July 12, 2021, from FactSet Database.

3. FactSet Research Systems. (n.d.). Exxon Mobile (interactive charts). Retrieved July 12, 2021, from FactSet Database.

Information provided is general in nature and does not constitute personalized investment advice. A professional adviser should be consulted before implementing any of the options presented. Any tax and estate planning information provided is general in nature and should not be construed as legal or tax advice. Always consult an attorney or tax professional regardin g your specific legal or tax situation.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

Sincerely,